Understanding technological maturity in fleet management

Understanding technological maturity in fleet management

In the first FSN Research study of 2023 we have partnered with GPS Insight | FieldAware to better understand the relationship between fleet management and field service operations…

Our goal in the study is to understand if the two business units work together and use these shared tools to drive efficiencies across the business as a whole or if they’re being used in isolation.

Across a series of articles, we will now explore the findings of the study’s quantitive phase, presenting the data with little editorialisation so you can see the trends directly. In this second article in we explore the study segment was designed to better understand the respondent group’s maturity with their fleet management technology.

As in the previous section of this report, the purpose of this series of questions is to allow us to understand how many disparate systems are in the technology stack in relation to field and fleet and also see how data can move from the solutions in place for both disciplines.

Having established a reasonable understanding of the FSM technology stack, let us look at field service organizations’ fleet management tools.

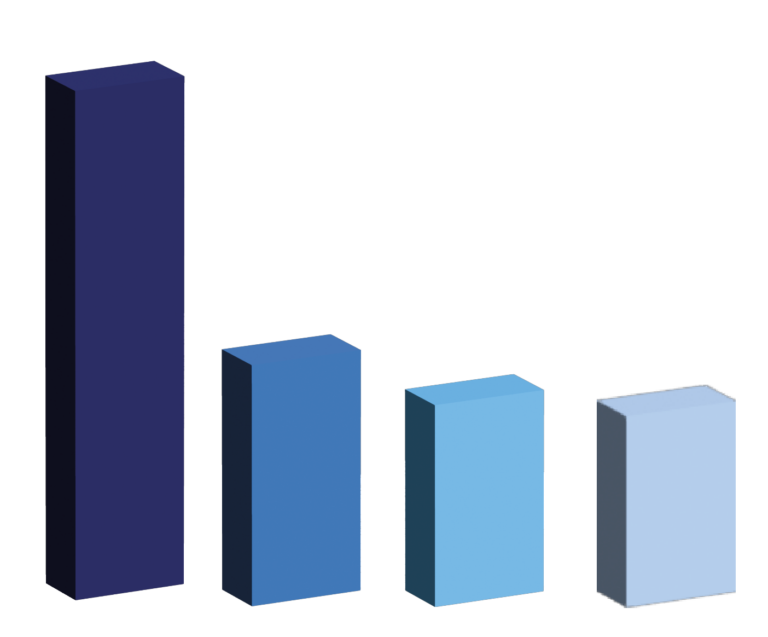

When we look at the most common fleet management technology cited by those in the study, it is probably very little surprise to see that GPS tracking is almost universally adopted – with 91% of organizations having GPS technology within their fleet. If anything, given that the majority of modern Light Commercial Vehicles (LCVs) used by field service organizations in their fleets will have a layer of GPS included as standard, this is largely to be expected.

Amongst the other technologies used in fleet management, however, there is far more significant variance amongst different organizations.

Of the other technologies listed, the second most prevalent and widely used was driver behavior technology which 43% of companies stated that they used.

What is particularly interesting about this being the second most commonly used fleet management technology is that this is a clear indicator that for these organizations, at least, there is a clear understanding that by giving the field service engineers tools to improve their driving performance, there are significant benefits to the bottom line that can be gained.

Alongside driver behavior technology, another widely used solution was fleet management technology cited was fleet maintenance s

In the first FSN Research study of 2023 we have partnered with GPS Insight to understand better the relationship between fleet management and field service operations…

Our goal in the study is to understand if the two business units work together and use these shared tools to drive efficiencies across the business as a whole or if they’re being used in isolation.

Across a series of articles, we will now explore the findings of the study’s quantitive phase, presenting the data with little editorialisation so you can see the trends directly. In this second article in we explore the study segment was designed to better understand the respondent group’s maturity with their fleet management technology.

As in the previous section of this report, the purpose of this series of questions is to allow us to understand how many disparate systems are in the technology stack in relation to field and fleet and also see how data can move from the solutions in place for both disciplines.

Having established a reasonable understanding of the FSM technology stack, let us look at field service organizations’ fleet management tools.

When we look at the most common fleet management technology cited by those in the study, it is probably very little surprise to see that GPS tracking is almost universally adopted – with 91% of organizations having GPS technology within their fleet. If anything, given that the majority of modern Light Commercial Vehicles (LCVs) used by field service organizations in their fleets will have a layer of GPS included as standard, this is largely to be expected.

Amongst the other technologies used in fleet management, however, there is far more significant variance amongst different organizations.

Of the other technologies listed, the second most prevalent and widely used was driver behavior technology which 43% of companies stated that they used.

What is particularly interesting about this being the second most commonly used fleet management technology is that this is a clear indicator that for these organizations, at least, there is a clear understanding that by giving the field service engineers tools to improve their driving performance, there are significant benefits to the bottom line that can be gained.

Alongside driver behavior technology, another widely used solution was fleet management technology cited was fleet maintenance software which 36% of the organizations in the study stated they were using.

![]() Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content GPS Insight who may contact you for legitimate business reasons to discuss the content of this briefing report.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content GPS Insight who may contact you for legitimate business reasons to discuss the content of this briefing report.

This content is available for FSN PRO members and also for a limited period for FSN FREE members. Please make sure you are logged in to access this content.

Not yet subscribed? Instantly unlock this content and more on our forever-free subscription tier FSN FREE

Join FSN FREE today!

Subscribe to our forever-free subscription tier FSN FREE by completing the brief form below and get instant access to this resource plus a selection of premium resources every month.

[pmpro_signup submit_button="Get access now!" level="1" redirect="referrer" custom_fields="true" short="true"]

Some browsers may not support our quick-register pop up function. If you cannot see a red button above this message then click here to head to the FSN FREE registration page instead.

"One area of in-vehicle technology that may be used by a smaller number of field service organizations than we might have anticipated is dashcams..."

Fig.2 Most commonly cited fleet management technologies being used.

From left to right: GPS system (91%), Driver behavior (34%), Fleet maintenance (36%), Daschcams (37%).

Interestingly, a much smaller group, only 12% of the total study respondents, used a dedicated vehicle maintenance app.

This could be interpreted to suggest that fleet maintenance is an aspect that perhaps doesn’t require the instant accessibility of an app on the device used by field service engineers and technicians. For many, a fleet management software solution is deemed to be sufficient in this regard.

One area of in-vehicle technology that may be used by a smaller number of field service organizations than we might have anticipated is dashcams. Surprisingly less than half (34%) of the companies had dashcams installed within their vehicles. Of these companies, only 13% had internal views within their dashcams.

Given the multiple benefits of both internal and external dashcams, the role they can play in mitigating insurance costs and the relatively low cost of high-end solutions (such as those provided by our study sponsor, GPS Insight | FieldAware), the relatively low representation of companies using these tools is somewhat surprising.

However, it does offer a relatively easy and cost-effective opportunity for many field service organizations to improve their fleet management capabilities.

Perhaps the follow-up question was the most compelling insight from these two initial questions. We asked if any organizations had integrated solutions for field service management and fleet management business operations.

Not a single company within our response set stated that this was the case, so in terms of how the solutions are embedded in service organizations, it is evident that the two remain in distinct silos. The question is whether that is also true for data moving across the systems in place for both business units – which we will explore further in the next section of this report.

Do you want to know more?

If you are already a subscriber you can access the report instantly on the ‘read now’ button below. If the button is not showing and you are already a subscriber then please log-in and refresh this page.

Not yet subscribed? Instantly unlock this content and more on our forever-free subscription tier FSN FREE

Join FSN FREE today!

Subscribe to our forever-free subscription tier FSN FREE by completing the brief form below and get instant access to this resource plus a selection of premium resources every month.

[pmpro_signup submit_button="Get access now!" level="1" redirect="referrer" custom_fields="true" short="true"]

Some browsers may not support our quick-register pop up function. If you cannot see a red button above this message then click here to head to the FSN FREE registration page instead.

![]()

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content GPS Insight who may contact you for legitimate business reasons to discuss the content of this briefing report.