Other Disruptive Forces Shaping Our Industry

In a new series of features from the latest Field Service News Research study hosted in partnership with ServiceMax, we explore the correlations between asset data flow, servitization and cross-department collaboration.

Having explored the lasting impact of the pandemic in the last feature in this series, now we shall discuss other important disruptive forces field service companies are adapting to.

The widespread adoption of remote service is not unexpected. Indeed, in previous Field Service News studies, we have seen now clearly seen this trend evolve across the pandemic.

However, while the impact of the pandemic has, as we outlined in the introduction to this report, been one of unprecedented disruption, there have also been many other disruptive forces across the field service sector that either predated the pandemic or indeed have since emerged either independently of or as a bi-product of the pandemic.

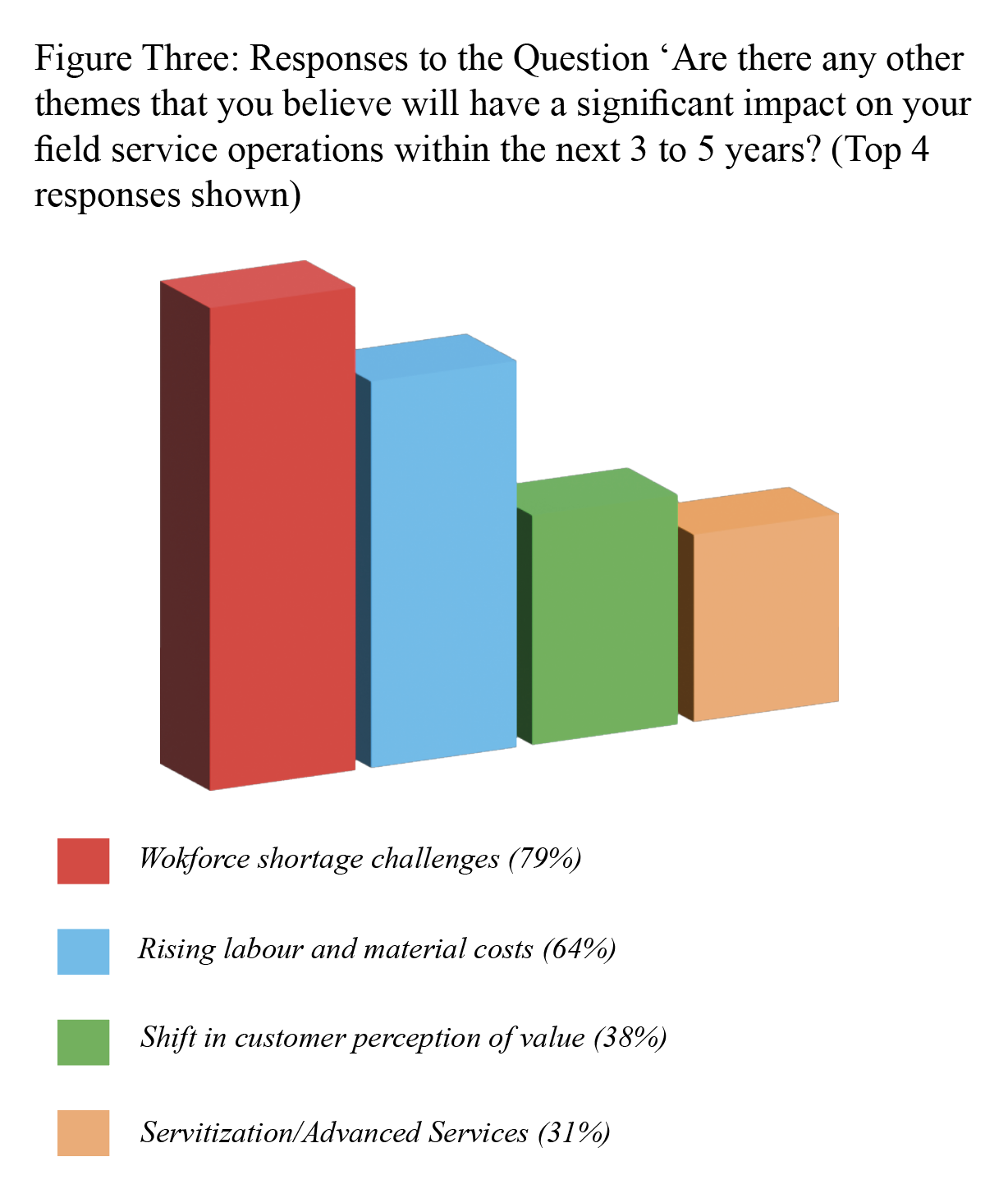

As we begin to look forward to a post-pandemic era for our sector, we must fully understand all of the external disruptive influences field service organizations may face. With this in mind, we asked our respondents if they felt any other themes they believed would have a significant impact on their field service operations within the next three to five years, asking respondents to cite the three most pressing in a range of options.

The answers to this question highlighted a challenge that our industry has been grappling with long before the pandemic – workforce shortage challenges. The threat of an ageing workforce crisis within our sector has been one that has been discussed for at least a decade, and the data from this study certainly indicates that we are increasingly edging towards that crisis, with 79% of respondents citing this as a critical concern. (fig.3 below.)

The second most widely cited trend in this question was another perennial challenge field service companies faced–rising costs of labour and materials. Almost two thirds (64%) of respondents cited this response.

Indeed, while this is almost always an area of concern, this could be the most extended ongoing impact of the pandemic as we are still grappling with the breakdown of supply chains and the economic downturn that many would argue the pandemic was a significant catalyst for and we are seeing staggering volatility in materials currently such as lumber which rose an incredible 375% between April 2020 and April 2021 and then suffered it’s worst month as a commodity in terms of price fall since 1978 in June after falling by 18% across this year.

The third most widely cited response was a shift in customer perceptions of value and expectations, which was cited by 38% of respondents. It is interesting to note that the subsequent most commonly cited response was the growing momentum of Servitization/Advanced services which 31% of respondents identified.

In many respects, these two responses are different sides of the same coin – both ultimately lead to a change in service requirements. When we look at these two responses together, we see that almost three quarters (69%) of the respondents believe the need for new service design is set to have a major disruptive impact on our industry in the coming years.

We would expect both new competitors and regulatory market pressures to remain a potential area of disruption, with a quarter of respondents including each of these options within their top three areas of concern. There were also emerging concerns cited by our respondents that could have a disruptive aspect on our industry.

These were sustainability (cited by 18% of respondents) and the developing right to repair sentiment and regulations (cited by 13% of respondents). Again it is interesting to note that both of these topics are increasingly becoming part of the broader discussions around servitization and service design.

Integral to these newer approaches to service design is the ability to access data across the business and be able to leverage that data into meaningful, actionable insight. In the next section of this study, we turned our attention to how prevalent such data flow is within our sector.

In the next article in this series, we will look at the effective use of data within the field service business unit. Want to know more and don’t want to wait? Field Service News subscribers can access the full report on the button at the top of this article.

This Field Service News Research study is sponsored by ServiceMax

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content ServiceMax who may contact you for legitimate business reasons to discuss the content of this white paper.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content ServiceMax who may contact you for legitimate business reasons to discuss the content of this white paper.