What are the drivers for developing servitization offerings?

What are the drivers for developing servitization offerings?

When we reflect back on the many industry discussions around servitization, there are three fundamental reasons why companies choose to develop a servitized offering within their service portfolio.

These are generally as follows:

- Longer term contracts

- Greater profitability

- Becoming more embedded within customer operations

However, when we go beyond these headline benefits, we often find that many of the key organisations that are held up as examples of servitization were driven down this path either by a market or customer pull.

For example, Rolls Royce’s famous power-by-the-hour solution was originally developed to support their Viper engine, although it soon evolved from a significant number of customer pulls from both commercial and defence sectors that wanted to expand on this new approach to pricing. Another excellent example of servitization would be MAN Trucks UK.

The innovation within their servitized solution was borne out of the necessity of an industry (haulage) that had simply no further margins to squeeze. With profit lines already paper thin, there was little room for growth for a truck manufacturer already 5th place in a congested market.

However, by working with the industry to improve the margins of operation, they were able to grow from 50 million to 500 million within a decade.

Often, this detail can get overlooked in the discussion around servitization. We rarely look at the drivers behind the innovation and, perhaps, naturally, more directly at the innovation itself.

Yet, with more and more organisations embracing servitization, it is important to understand whether these drivers of either market or customer pull that are consistently present in many of the early case studies of servitization remain essential or if servitization has become a mainstream enough strategy that the pendulum has swung, and service providers are able to successfully persuade their customers.

Or perhaps, as we touched on earlier in this report, has the pandemic introduced a new wave of customer pull that is further driving the need for more servitized offerings across manufacturing sectors?

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content HSO who may contact you for legitimate business reasons to discuss the content of this briefing report.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content HSO who may contact you for legitimate business reasons to discuss the content of this briefing report.

This content is available for FSN PRO members and also for a limited period for FSN FREE members. Please make sure you are logged in to access this content.

Not yet subscribed? Instantly unlock this content and more on our forever-free subscription tier FSN FREE

Join FSN FREE today!

Subscribe to our forever-free subscription tier FSN FREE by completing the brief form below and get instant access to this resource plus a selection of premium resources every month.

[pmpro_signup submit_button=”Get access now!” level=”1″ redirect=”referrer” custom_fields=”true” short=”true”]

Amongst those organisations who were currently in the process of developing a servitized element to their service portfolio, the emphasis on driving revenue was even further magnified, while the impact of customer pull was reduced.

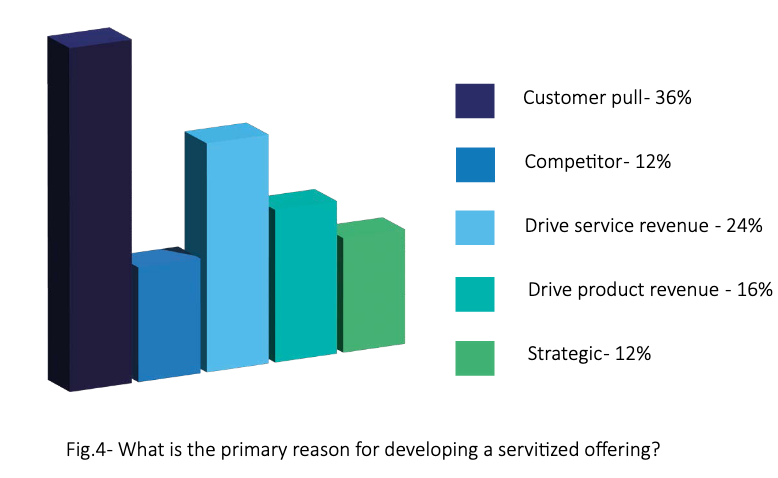

We presented this question to both those who stated they had already provided a servitized offering and to those who were actively developing such an offering and gave them five primary options to select from.

These were:

- Customer pull

- Reacting to competitors

- Designed to drive additional service revenue

- Designed to drive additional revenue in our product sales

- Strategic move to disrupt the market

Amongst those companies who had already developed a servitized offering, customer pull indeed remains the most prevalent driver, which was cited by over two-thirds (36%) of the organisations within the study response set.

The second most widely cited response was to drive additional service revenue, which just under a quarter (24%) of respondents in the group cited. However, it is important to note that when combined with the option to drive additional revenue from product sales which 16% of respondents cited, then driving additional revenue generation was the most widely cited response across the group accounting for two-fifths (40%) of responses.

Interestingly, the most reactive option in the response set, i.e. reacting to competitors and also the most progressive option, i.e. a strategic move to disrupt the market, were both equally cited with the joint lowest number of citations from this group at 12% each – bookending either side of the chart.

Amongst those organisations within the study who were currently in the process of developing a servitized element to their service portfolio, we saw a continuation of this pattern, although the emphasis on driving revenue was even further magnified, while the impact of customer pull was reduced.

Amongst the organisations that have already developed a servitized element in their service portfolio, we certainly still see the majority of organisations having their servitization program driven by either the CEO or the executive board.

Drivers for additional revenue were both cited by approximately a third of respondents as the primary driver, with driving service revenue being cited by 35% of respondents in this set while driving additional product revenue was cited by 32%.

Therefore, with over two-thirds (67%) of the respondents introducing a servitized element into their service portfolio to drive additional revenue, the question of whether we are witnessing a shift from customer/market pull to service provider push does certainly become evident.

Customer pull within these organisations, who currently find themselves in the development stage of their own servitization journey, certainly remains a common driver, with over a fifth (21%) of organisations in this group stating this to be the case.

Having explored the drivers for adopting servitization, the next area we wanted to consider within this study was who was the driving force within the organisation behind the move.

Given that the effective development of servitization requires the buy-in from all business units within the organisation and entails a broad strategic shift, traditionally, servitization is driven from the executive level.

However, with the increasing focus on service innovation and the ongoing requirement for identifying new revenue opportunities, particularly in the current challenging economic environment, are those in sales or service leadership roles playing a role in driving servitization?

Amongst those organisations that have already developed a servitized element in their service portfolio, we certainly still see the majority of organisations having their servitization program driven by either the CEO or the executive board.

In fact, this is the case amongst over two-thirds (67%) of companies. However, almost a quarter (24%) of companies stated that their servitization initiative was driven by service leadership. This is a significant number and, again could be seen as an indication of how we see the growth of servitized business strategies, we are also seeing the growing importance of the service leaders within an organisation.

It is interesting to see that while service leadership appears to be gaining a greater share of influence amongst organisations that see servitization as a part of their strategic business future, sales leadership is far less frequently driving such innovation.

Of course, given the nature of our audience, which is predominantly comprised of service leaders, we do have to take into account that there will certainly be a layer of bias that could skew this particular set of results within the study.

Do you want to know more?

If you are already a subscriber you can access the report instantly on the ‘read now’ button below. If the button is showing ‘Join FSN FREE’ please log-in and refresh the page.

If you are yet to subscribe simply click the button below and complete the brief registration form to subscribe and you will get instant access to this report plus a selection of premium resources each month completely free.

This content is available for FSN PRO members and also for a limited period for FSN FREE members. Please make sure you are logged in to access this content.

Not yet subscribed? Instantly unlock this content and more on our forever-free subscription tier FSN FREE

Join FSN FREE today!

Subscribe to our forever-free subscription tier FSN FREE by completing the brief form below and get instant access to this resource plus a selection of premium resources every month.

[pmpro_signup submit_button=”Get access now!” level=”1″ redirect=”referrer” custom_fields=”true” short=”true”]

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content HSO who may contact you for legitimate business reasons to discuss the content of this briefing report.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content HSO who may contact you for legitimate business reasons to discuss the content of this briefing report.