5 Enemies of Growth: What is Hitting Field Service Firms Hard?

In this third feature of a series of excerpts from a recent white paper published by BigChange, we analyse the key issues that hit field service businesses in the past 12 months.

Despite rapid growth, businesses with field-based teams reported three key issues that had materially hit their business in the past 12 months.

1. Covid-19 and its consequences

81% of businesses said the pandemic had hit turnover or profits in the last 12 months. Four in ten reported that it had led to staffing difficulties.

2. Expensive materials and fuel:

Three-quarters of companies say the rising cost of materials (76%) and fuel (74%) are hurting their business. In the 12 months covered, pump prices for petrol rose by 18% t o near-record levels; diesel leapt by 16%.

Firms expect the same factors to dampen or even eliminate profitability in the next 12 months.

3. Staying within the rules and regulations

Compliance challenges – including those stemming from the pandemic – are hurting firms. Two-thirds of field service companies say that new regulations hit their profits in the year to July 2021.

In the last 12 months, more than half breached industry regulations in ways that led to a fine, loss of reputation or loss of work. A quarter (25%) incurred financial penalties for breaches.

The risk of accidentally contravening rules and regulations increases as companies expand rapidly. Two further issues for firms also emerged in our analysis.

4. The productivity pinch point

When it comes to employment, the trades have outperformed the rest of the economy in the last year. The number of people working in field service firms increased by 48%.

But this increase was slower than the 70% rise in workloads.

Firms anticipate further growth in workloads (74%) in the next 12 months, and a lower increase in the extra employees they will take on (54%).

There will be pressure on already busy field service teams to work even more efficiently.

5. Rising debt levels

The amount of debt taken on by field service businesses increased by 50% over the last 12 months.

While some businesses have used finance to underpin their expansion activities (average debt increased by 43% at firms reporting good profit and growth prospects), the biggest increases in debt levels were among loss-making firms borrowing for survival.

Average debts were up 117% over the last 12 months at businesses that said they were struggling and feared going out of business and increased by 61% at loss-making firms where leaders believed a turnaround was possible.

Access to Government-backed finance made it easier for most businesses to borrow last year. This debt will add an additional cost burden to some already struggling firms.

STATE OF THE FIELD SERVICE SECTOR

Demand and workloads are soaring. Essential costs are on the rise. And recruitment is challenging. Many firms in the survey have addressed these challenges by pushing hard to improve productivity.

Where is time and money lost in field service businesses?

Poor management oversight: 27% said difficulties getting complete and up-to-date management oversight stops them from working as efficiently as possible. 82% want oversight of all parts of operations in real-time.

Outdated technology: Clunky legacy workforce-management systems that couldn’t keep pace with the demands of today were an efficiency issue for 27% of firms.

Poor planning and workflow: 24% say that wasted time between jobs, including travel, is harming efficiency efforts.

As a result, many are now looking to optimise operations with technology.

Less strain, efficiency gain: The rise and rise of job-management technology

73% of field service businesses increased investment in technology in the last 12 months. Technology spending increased by an average of 54% year on year.

Firms expect to keep up these rates of tech-spending growth into 2022 as they turn to technology for management oversight, process automation, job scheduling and route planning.

Year on year company growth was faster, on average, for users of field service management technology. And those growing quickly are doubling down on technology: they are more likely than other firms to invest in it over the next year.

Productivity

Where is time and money lost in the field service business?

- 27% say difficulties getting real-time insights harms efficiency

- 27% of firms felt outdated technology was an efficiency issue

- 24% say wasted time between jobs is harming efficiency

This content is sponsored by BigChange

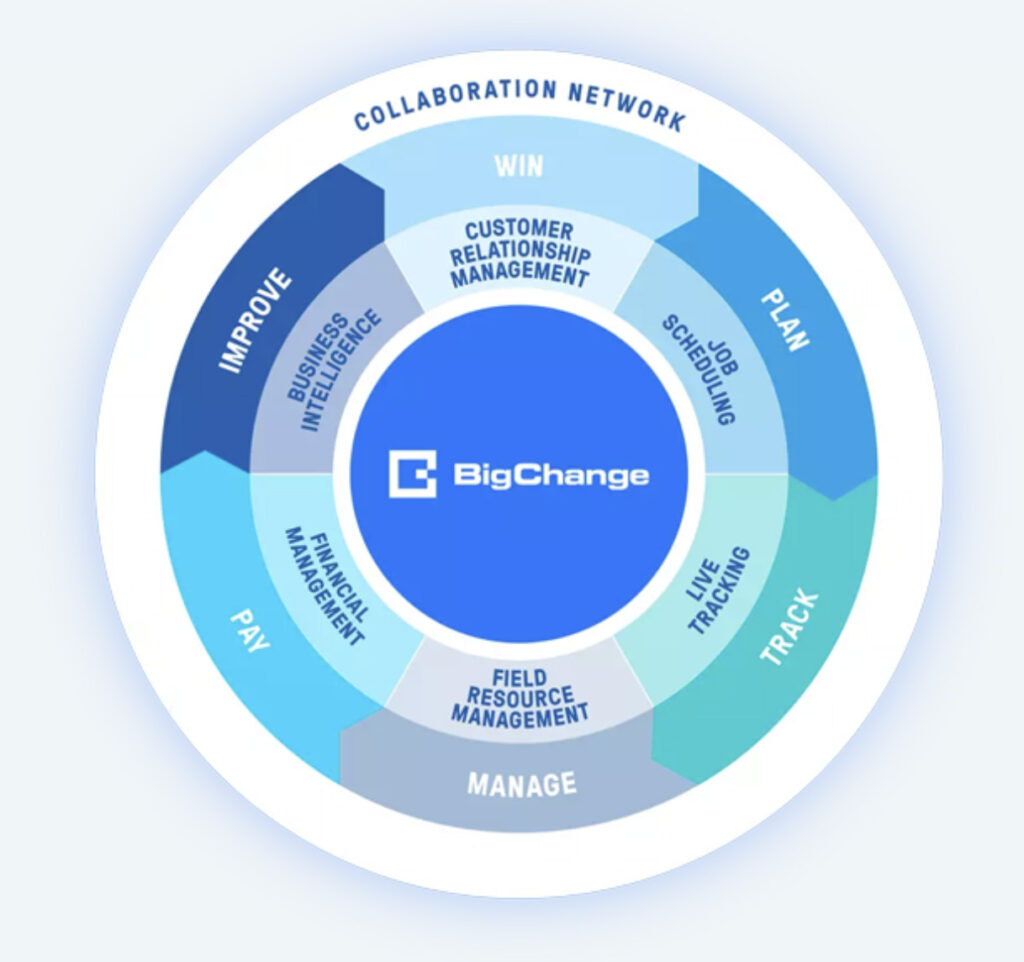

TAKE CONTROL WITH THE COMPLETE JOB MANAGEMENT

PLATFORM

Simplify how your business runs, connect your office and field workers and manage your entire operation from quotation to invoice on a mobile or tablet.