Why overlooking management is a costly mistake.

Across all service-centric sectors, a universal maxim is that an organisation’s most valuable resource is its staff.

We exist in a service-centric economy, one where an effective workforce can and does bring competitive advantage, and a misfiring workforce can lead to multiple problems that could impact revenue, operations and customer and employee churn.

Indeed, despite the repeated challenges of the last twelve months, the field service sector kept rumbling onwards, driven by an exceptionally dedicated workforce.

However, as we look forward to recovery, we are now facing many questions about the future workforce of the future.

Therefore, it is vital to understand what defines the best-in-class management of this most valuable asset, our staff.

To further clarify this picture, Field Service News Research has partnered with HR specialist solution provider Goodt to broaden this particular study’s scope beyond the traditional field service sector and into the wider services sector.

In particular, we have expanded this specific study to include the retail and hospitality sectors. In terms of many core aspects of human resource management, including gamification and managing employee churn, these sectors have often driven many trends that are becoming more widely adopted across service-focused sectors.

The key overarching questions we were seeking to answer in this study were:

- What are the key metrics for identifying positive workforce management?

- How are companies ensuring that their workforce is optimised both in terms of finance and productivity?

- What tools are being used amongst service-centred organisations to manage their workforce?

- What does best practice look like in terms of employee engagement?

These questions formed our survey’s basis as we begin to understand what workforce management may look like in the new normal. To find out more, Field Service News Research, in partnership with Goodt has undertaken a highly focused research study, talking to over 80 field service management and human resource leaders across the world.

These companies are from various industry verticals, including Manufacturing, Utilities, Aviation, Pharma, Telco, Med-Tech, as well as retail, hospitality and others.

The study was held on a global basis so with representatives from all regions of the world.

The study was held across February and March 2021.

Across the following weeks, we will begin to look at the key findings of this study and outline the critical early trends of this essential conversation that must be evaluated both within the field service sector and beyond.

The Key Metrics That Define Workforce Management Success

The initial starting point for the study was defining precisely what is considered success within workforce management and, from there, determining the metrics that were being commonly measured to track performance.

To do this, it is important to take a moment to define the difference between a Key Performance Indicator (KPI) and a performance metric. Although the two are often used synonymously, they can and should be viewed as very different.

Essentially, a KPI is an instrument to outline how a segment of an organization is moving in line with the broader over-arching business strategies. Most metrics, on the other hand, while providing insight at a divisional or line manager level, usually don’t necessarily align with the organizational strategy.

For example:

- Average interviewing cost

- Average length of placement

- Average length of service

- Average salary

- Average number of training hours per employee

are all not examples of KPIs but are examples of workforce management metrics. They would be helpful for individual HR departments; however, it was essential to understand the broader KPIs related to this area for this study.

The reasoning behind this was that we wanted to assess workforce management metrics that sit as part of broader organizational strategy and, given the horizontal rather than vertical nature of the field service sector and, these more critical top line metrics would translate to cross-industry best practice.

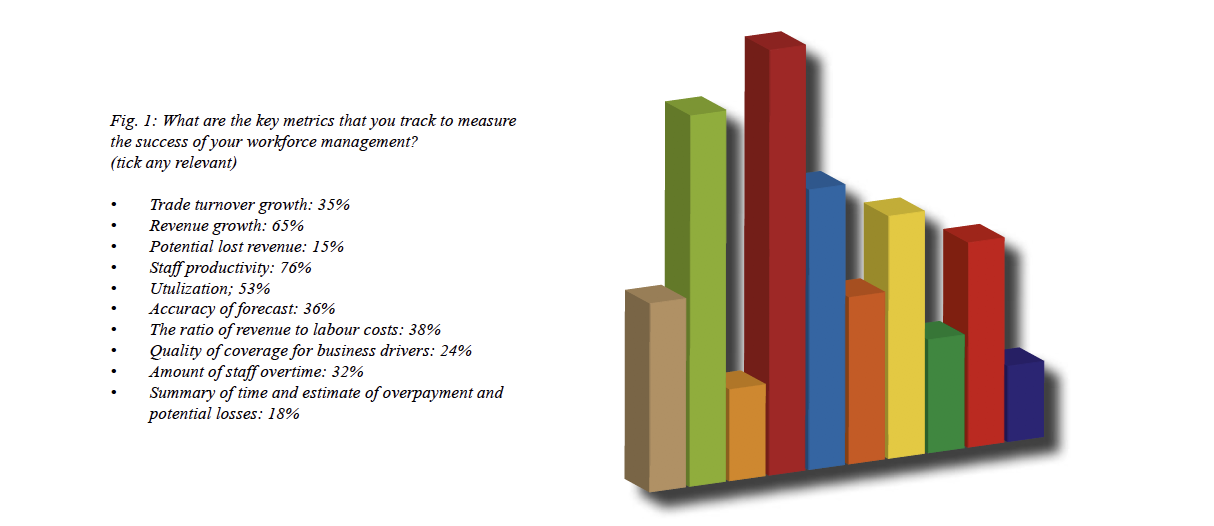

With this in mind, we gave the study respondents a selection of the following metrics. We asked them to identify which within this group they measure to determine their workforce management’s success.

The options were; trade turnover growth, revenue growth, potential lost revenue, staff productivity, utilization, accuracy of forecast, the ratio of revenue to labour costs, quality of coverage for business drivers (including both under-coverage (potential loss of sales due to lack of staff) and over-coverage (downtime – overpayment for ineffective time), amount of staff overtime, summary of time and estimate of overpayment and potential losses.

As we can see from the chart below (figure 1), perhaps somewhat predictably, the most critical metric that our respondents identified within workforce management against this context was staff productivity. While on the surface, this may be a fairly obvious, it does underline the importance of many of the areas we will explore later in the study – particularly when we begin to discuss the importance of employee engagement.

As anyone who has managed a team, whether it be a small group or hundreds, will attest, productivity will consistently be increased when that team is pulling in the same direction and has a shared vision of the mission goal. Fostering a genuine collegiate approach is essential in achieving such unity within a team.

Indeed, this is a challenge that is further magnified, yet even more critical when that team comprises field-based workers who are more susceptible to being isolated due to their work’s remote nature.

One set of trends of particular interest in the study sits around the second most commonly cited KPI our respondents selected. We see that 65% of respondents stated that revenue growth was an essential measure of their workforce management programs’ success. There are two interesting facets to this data.

Firstly, it is interesting to note the juxtaposition of revenue growth versus revenue protection. While almost two-thirds of respondents saw revenue growth as a measure of workforce management success, less than a fifth (15%) of respondents stated that protecting against potential lost revenue was an important KPI. This is interesting, because to a degree, these metrics are different sides of the same coin. Yet, we included both options within the question because they do outline whether an organization has a defensive or aggressive mindset.

Given the pandemic’s ongoing uncertainty, we felt it would be an interesting bell-weather to see if the overarching mood amongst respondent companies was of a positive growth outlook or a more cautious protectionist mindset.

In a previous study undertaken by Field Service News Research at the end of 2020, which benchmarked many of the changes ushered into the field service sector throughout the pandemic, we saw that 76% of field service companies, despite all of the challenging marketing conditions, were focused on growth rather than survival. Here in this study, while focusing on an entirely separate area of service management, it is therefore interesting to note again that the metrics of success remain growth-focused.

Another critical aspect for field service organizations to note around this alignment of financial growth with workforce management is that there remains a vast untapped potential of revenue growth amongst most field workforces.

Indeed, it has become something of a perennial question for field service leaders ‘how can we leverage the trusted advisor status of our field service engineers and technicians to generate revenue directly from the field?’ While there remains huge debate within our sector about the validity of doing so and how to approach such projects, it is undeniable that the opportunity for increasing revenue streams from field workers is an appealing one.

If you are a field service management professional still trying to solve this equation, the newly launched FSN Elite membership platform has a four and a half-hour course on just this topic, led by Jim Baston, who is widely acknowledged to be one of the leading thinkers in this area globally.

The course guides you by building a framework of how you could increase revenue from your field workers. It is the first of several such courses that are part of the Field Service News Masterclass program and is available for at a discounted rate to all FSN subscribers members.

Other vital metrics cited by our respondents as necessary KPIs relating to their workforce management programs again dovetail neatly with the often-cited operational KPIs of field service management.

For example, over half (53%) of the companies within our response set stated that staff utilization was a critical KPI that denoted success in their organization.

In a similar vein, the ratio of revenue to labour costs was also highly cited.

Almost two-fifths of respondents also selected this as a critical KPI when determining their workforce management programs’ success.

Again this is something that translates well across all service organizations.

Given the remote nature of field service roles and the travel times between jobs, this has traditionally been a challenging KPI for field service companies to improve upon. In one sense, the changes our industry has had to make due to the pandemic could well be something of a blessing in disguise here. In a study in late 2020, Field Service News Research revealed that over three quarters (83%) of field service organizations now have at least some form of remote service delivery capabilities.

If this is adopted effectively, this could significantly impact technician utilization rates and improve two other crucial field service metrics, namely Mean-time-to-resolution (MTTR) and First-Time-Fix (FTF) rates. With each technician’s capacity to serve multiple customers increased, it could also have a significant impact on revenue to labour costs.

Capacity planning is another aspect of workforce management that has proven to be hugely disrupted and very much likely will remain so at least across 2021 due to the pandemic. This will, of course, impact all workforces, whether they be in a fixed location or in the field, as we still manage the challenges of employees needing to self-isolate at any given moment.

Therefore, it is of little surprise that forecasting accuracy is another widely cited KPI, with over a third of companies (36%) citing this as a core KPI.

This content is available exclusively for FSN Premium members. Please either log-in or subscribe for access