Bouncing Back: How Demand Surged as UK Lockdowns Eased

In this feature taken from a white paper published by BigChange, we have a look at what happened in the field service sector after Covid measures began easing in the UK.

Britain’s trades have bounced back from Covid-19 lockdowns and disruption. And they expect more growth in the 12 months to come.

Plumbers, electricians, maintenance companies and other firms with field service staff report that workload, turnover, and profit have increased significantly since Covid measures began easing in July 2020. In the 12 months since then (August 2020-July 2021), these companies have reported:

- Turnover up by 79% on average (compared with the previous 12 months)

- Workload up by 70%

- Total profits up by 66%

A third of companies increased profits by at least 50%. Three-quarters (74%) increased turnover; a pattern repeated when it comes to demand for work and total profits. One in five has doubled turnover since July 2020. The sharp bounce back comes after a period (August 2019-July 2020) when Covid-19 significantly affected business activity.

Since then, growth has been particularly strong in the facilities management, fire and safety, hire, and plumbing and heating sectors. But surging demand is not benefiting everyone. For every strong, profitable business in the sector, another is struggling to keep up – just breaking even or even losing money.

Demand for facilities management, building maintenance, electrical contracting, fire and security, and plant hire services bounced back particularly robustly – each sector recording workload increases of more than 70% year on year.

AVERAGE GROWTH RATES FOR FIELD SERVICE FIRMS

Looking forward, more than eight out of ten firms expect turnover to grow into 2022. One in five (19%) expects to at least double turnover by next summer. Only 2% expect to be less profitable this time next year.

Overall, the picture is of surging workloads, turnover and profit – albeit from a suppressed start point. Like a coiled spring now released, the sector is growing very fast.

Many businesses will increase prices to help offset increasing costs. Prices charged across the field service sector rose by 47% in the last 12 months and are predicted to increase by a similar amount over the next year. However, there are still concerns that growth in profit will continue to lag behind the rise in turnover, and that predicted profit increases will not be enjoyed uniformly across the sector.

13% of field service firms say they are already struggling, and fear that they could go out of business in the next 12 months as costs continue to rise and Covid-19 support measures are phased out. This includes many that experienced booming demand last year, but couldn’t pass on their increasing costs to customers in the form of price rises.

STATE OF THE FIELD SERVICE SECTOR

- 22% of field service leaders told researchers their businesses were performing incredibly well, with good profit and growth prospects. This equates to 276,000 firms nationwide

- Half (50%) of these firms experienced increases in demand for their services of between 10% and 99% over the last 12 months, while another quarter (26%) saw workloads double

- On average, these strong growth businesses have seen workloads rise by 97% while achieving similar increases in turnover (99%) and profit (100%)

- These champion businesses increased employee numbers by 58%, prices by 62% and investment in technology by 76% in the last 12 months

- 26% of leaders, the equivalent of 323,000 UK firms, reported their businesses were succeeding in making a small profit each year

- Workloads increased by 57%, on average, ahead of both turnover (49%) and profit (43%)

- These businesses plan to increase prices by 42% over the next year to offset rising costs

- They expect to increase employee numbers by 37% and investment in technology by 42% in the year to July 2022

BIGCHANGE’S GROWTH MATRIX

- Around one in every eight leaders (13%) said their firms were currently losing money but expected to be able to turn their fortunes around over the next year. We estimate that 161,000 field service firms nationwide are in this situation.

- Increases in workload of 46% in the last 12 months were met by a 55% increase in employee numbers.

- 83% of these businesses said higher labour costs had hurt their businesses last year.

- Another 13% of leaders told researchers their firms were struggling to the extent that they could go out of business within the next year. This equates to a further 161,000 businesses across the UK

- Their struggles aren’t due to a lack of demand. Struggling businesses took on the highest average increases in workload (146%) and turnover (151%) of any segment

- However, meeting this demand required a 92% increase in employees, a factor that 91% price increases couldn’t offset

- 97% of strugglers said they were severely impacted by Covid-19, while the rising cost of materials, fuel and people were negative factors for more than 80% of these firms.

Further Reading:

- Read more about FSM Technology

- Read more about BigChange on Field Service News

- Learn more about BigChange

- Follow BigChange on Twitter

- Access 17 premium resources on Service Strategy (PRO)

- Access 23 premium resources on selecting and implementing FSM Technology (PRO)

- Access 24 premium resources on recovering from the pandemic and the new normal (PRO)

This content is sponsored by BigChange

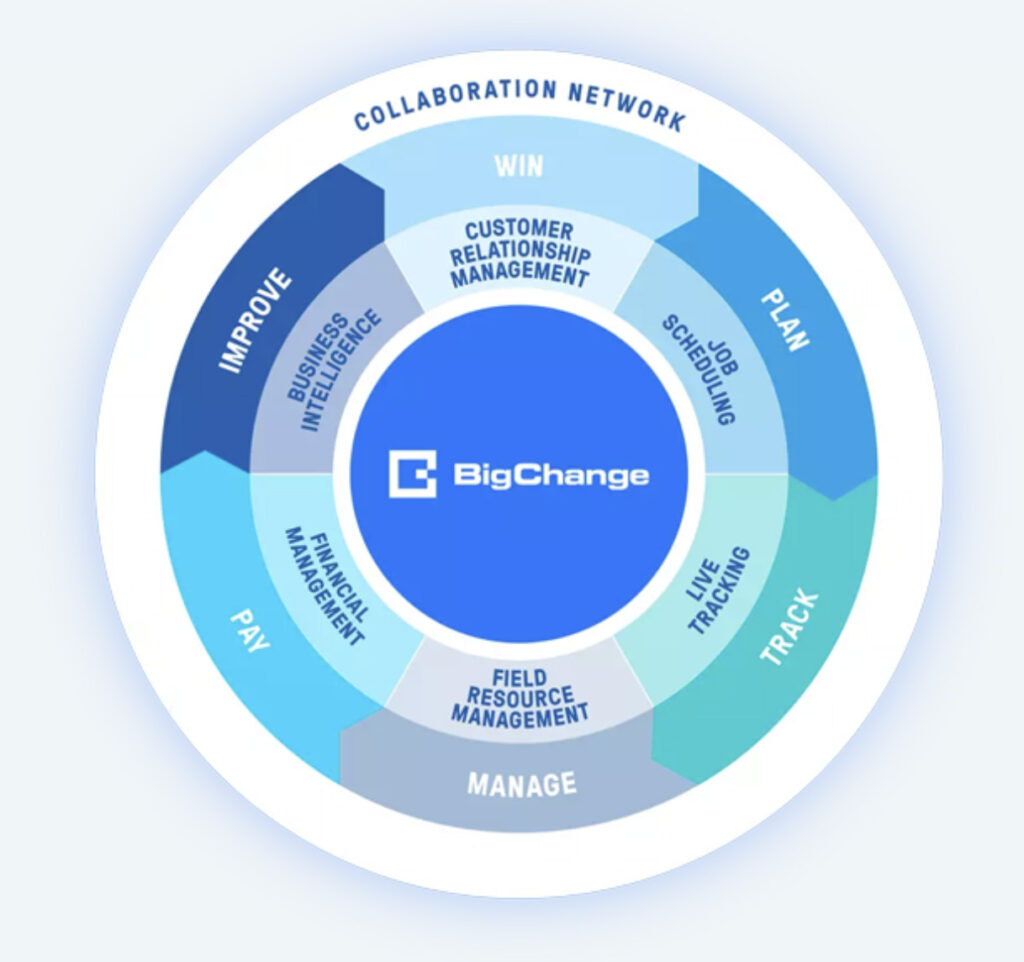

TAKE CONTROL WITH THE COMPLETE JOB MANAGEMENT

PLATFORM

Simplify how your business runs, connect your office and field workers and manage your entire operation from quotation to invoice on a mobile or tablet.