Reactive, Proactive, Advanced and the Future of the Field Workforce

In the next in our series of comparative analyses across a global study and a follow-up UK study hosted by Field Service News Research in partnership with HSO, we look at the balance between reactive and proactive service approaches amongst field service companies…

Within the global report, we saw several key trends emerge from the study. The global data showed that we have reached a point where much of the industry has a reasonable maturity in terms of technology adoption related to field service operations:

- We saw the importance of customer service within the top-line growth strategies of field service companies.

- We saw how the focus on digital transformation is aimed at driving improvements in customer service standards.

- We saw how the pandemic has significantly accelerated that digital transformation.

Now as we look at the comparative data from the UK only study, we have seen that:

- The importance of customer service within the top-line growth strategies appears universal across regions.

- Within the UK operational efficiency is a greater driver for digital transformation than customer service standards.

- The acceleration of digital transformation since the pandemic again is largely universal across regions.

Indeed, while there are some significant differences in specific areas of the findings of the two studies, the meta-trends do appear to remain across geographies. In our first report, we suggested that the findings of the global study indicated that the field service sector is ready to drive forward with the other key trend that we have seen companies develop across the last decade within our industry. A shift from traditional reactive break-fix approach, to service delivery through to a more sophisticated servitized approach.

Does this hold true of the UK response group as well?

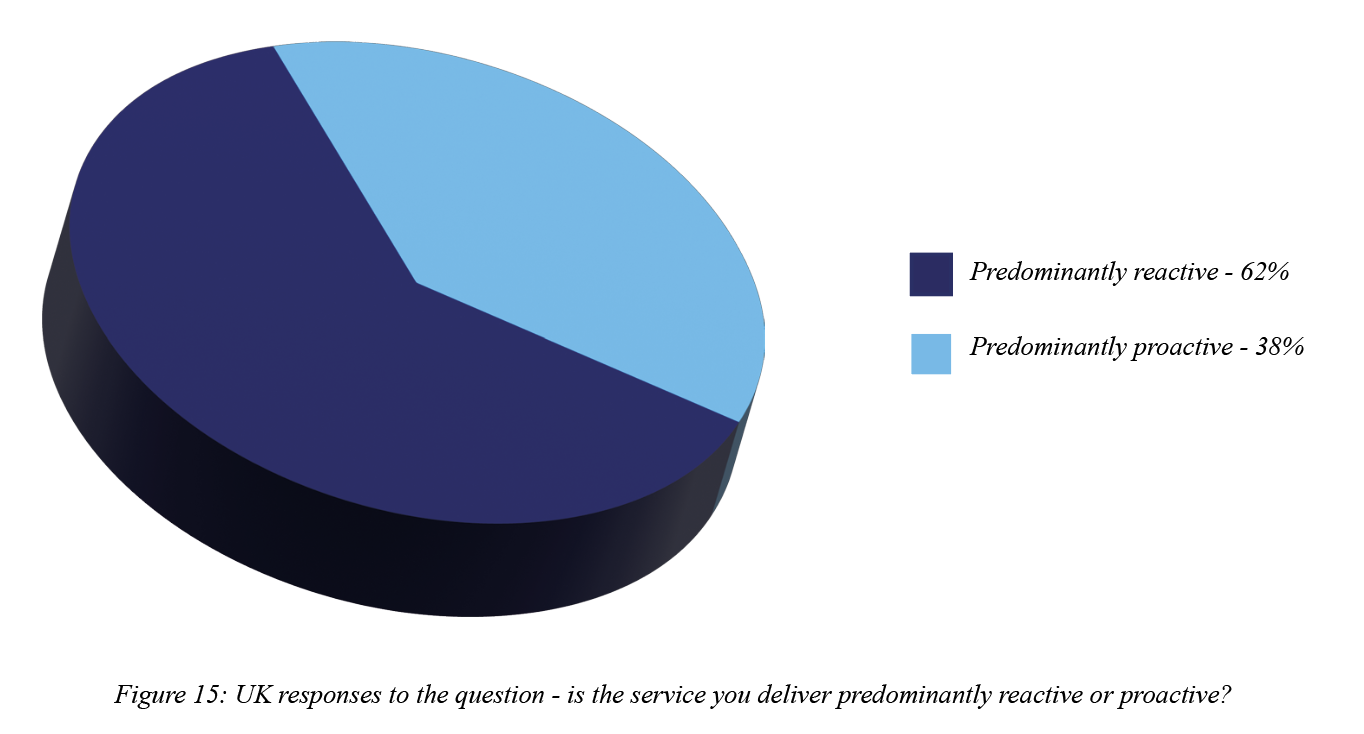

In the final part of our study, we focused on understanding whether we are beginning to see that shift occur. To begin, we wanted to understand how far we have come along the reactive to proactive spectrum as an industry. We asked our respondents to identify on a sliding scale whether their service was predominantly reactive or proactive.

The results from the global study to this question showed an industry very much in a moment of flux as the response across all respondents was 50/50 split between the two. Amongst our UK respondents, however, there was a slight leaning towards reactive service with 38% of field service companies in the study stating they are more pro-active than reactive. (Fig 15 below)

A similar trend was uncovered in the next question as well. In our reporting on the global study we saw a further indication of the shift towards advanced services. We asked our respondents if they offered any advanced services (i.e. servitization or outcome-based services) within their service portfolio.

Here we saw that nearly two-thirds (58%) of field service companies did have some form of advanced service offering within their service portfolio. Once again, the companies within the UK group were slightly less advanced with only 42% stating they had advanced services within their portfolio.

One observation that was made in the original report which is further emphasised by the UK data is that an advanced services offering does not necessarily mean abandoning your existing service models. As we have seen across this study, the importance of understanding customer needs and wants is increasingly at the heart of modern field service strategies.

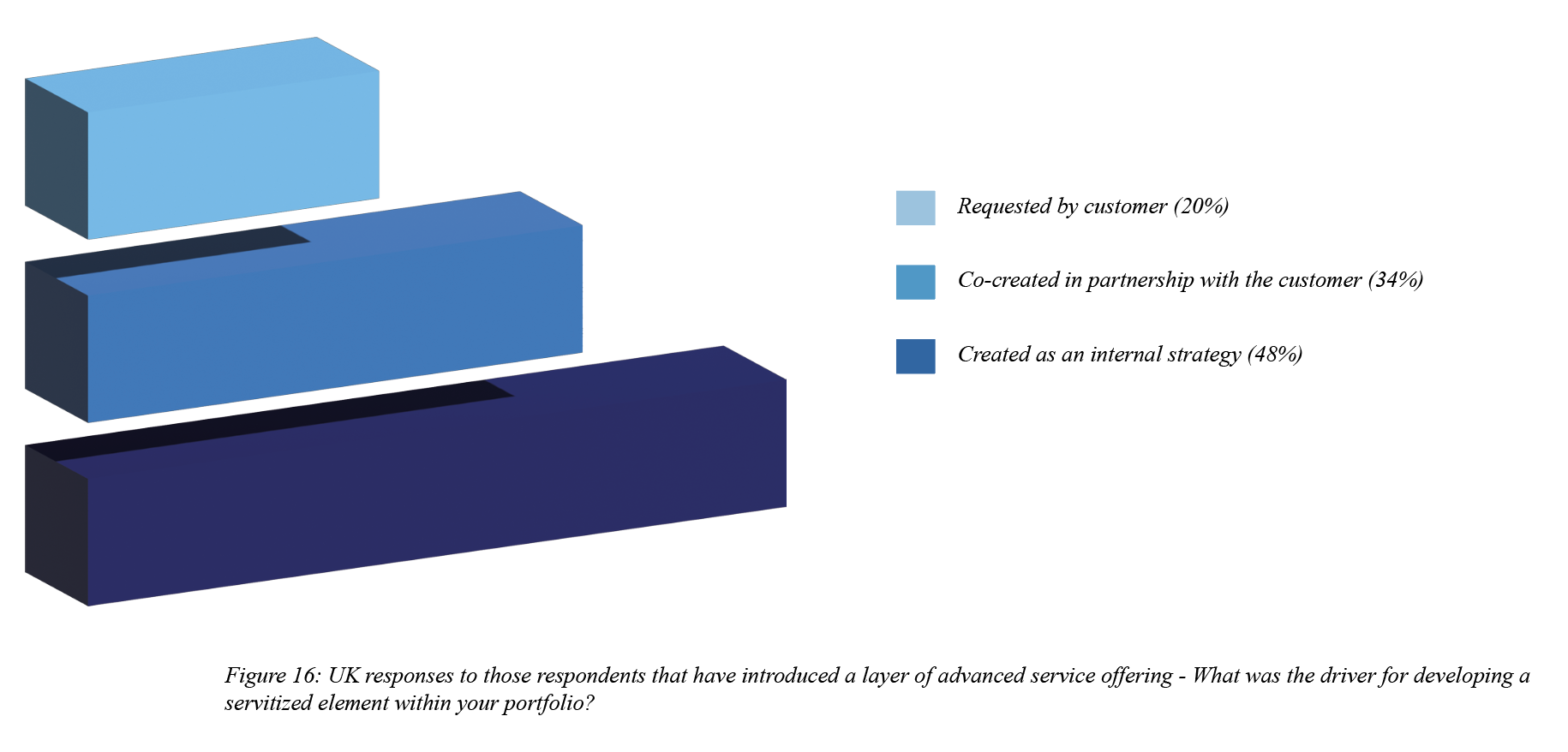

Indeed, as we delved further into how those companies with a servitized offering approached introducing this into their service portfolio, this observation was further borne out. While 51% of the field service companies within the global study had introduced such an offering as part of an internal strategy, 49% of companies had done so either in partnership and co-creation with their customers or their customers’ direct requests.

Here the UK findings were once again remarkably close to those we saw in the global study with 48% of companies introducing the offering as part of an internal strategy. (fig 16 below)

What is interesting, however, is that while over a third (34%) of UK companies developed such strategies as part of a co-creation program with their customers, almost a fifth of those UK companies with an advanced service offering introduced them at the request of their customers, something that wasn’t seen at all within the global study.

Finally, the other shift that aligns with this rapidly changing dynamic within the field service sector is the changing workforce models. The use of third-party workforces is becoming increasingly widespread. When correctly used, the blended workforce (a mix of internal and third-party field workers) has benefits closely aligned with the dual benefits of increasing customer satisfaction, while reducing cost within field service operations also shown to be being driven by digital transformation. Within this area, we asked our respondents to identify the mix on average between internal and third-party workers within their field workforce.

Across the entire response set from the original global study, the average blend of field workforce was 36% third party. Additionally, almost all external workers (87%) were from subcontractor firms. However, there are the seeds of the use of the gig economy being employed within field service roles as 12% of companies that use third party labour also hire from this pool.

However, this is an area in which the UK field service companies appear to be further forward. In total 45% of field workers within those companies represented within the study were third party workers. Additionally, the gig economy also seems further advanced in the UK with individual freelance workers making up nearly a fifth (18%) of third party workers.

In the final feature in this series we shall offer seven key takeaways from the two research studies.

Want to know more and don’t want to wait? Field Service News subscribers can access the full 20 page comparative analysis report on the button at the top of this article.

This Field Service News Research study is sponsored by HSO

This content is available exclusively for FSN Premium members. Please either log-in or subscribe for access

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content HSO who may contact you for legitimate business reasons to discuss the content of this white paper.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content HSO who may contact you for legitimate business reasons to discuss the content of this white paper.