Health Check of UK Businesses Running Field Service Teams

In this feature taken from a white paper published by BigChange, we look at their first health check of UK businesses running field service teams.

These trades are the backbone of the economy: plumbers, electrical engineers, construction businesses, maintenance companies, environmental services, and many others with field-based workers. One in five UK businesses rely on field service teams to deliver their services. We estimate that there are now more than 1.2 million field service businesses in the UK employing 6.7 million people.

Because they all run field service teams, they face similar opportunities and challenges:

- Managerial oversight

- Job scheduling and management

- Recruiting suitably skilled workers

- Compliance

- Maximising job efficiency

- Competing on customer experience

During August 2021, we engaged the research consultancy Opinium to survey businesses of all sizes with field service teams.

Opinium spoke to 504 leaders from businesses in the building maintenance, cleaning services, drainage, electrical contractors and electricians, facilities management, fire and security, plant hire, industrial doors, plumbing and heating, and the waste and recycling sectors.

We asked about business health and how they fared from August 2020 to July 2021 – the first full 12 months since the easing of the strictest UK lockdown measures.

72% OF THE UK FIELD SERVICE BUSINESSES ARE GROWING, BUT ONLY ONE-IN-FIVE ARE GROWING STRONGER

- Workloads are up 70%, and turnovers have soared as prices charged for services increased by an average of 47%

- Demand for facilities management, fire and safety, plumbing and heating, and plant hire services bounced back particularly well

While the headline figures are positive, the benefits of booming demand are not enjoyed by everyone

- Turnovers rocketed across the sector, yet fewer than half of companies reported making a profit. 26% of firms lost money in the 12 months to August 2021 as the industry was hit by Covid-19 complications, compliance issues and surging costs

- One in eight field service firms fear they could go out of business within a year

- More than eight out of ten firms expect turnover to grow into 2022. But a talent crisis means firms face this increased demand without employee numbers increasing at the same rate. 56% of field service leaders reported difficulty retaining frontline operators.

Productivity is now a major focus for field service firms

- Poor management oversight, outdated technology, and poor planning and workflow were significant barriers to more efficient work. 82% of field- service leaders said they wanted oversight of all parts of their operations in real-time

Our analysis indicates that there is a big difference between growing and growing stronger

- The strongest firms took advantage of rising demand to do more work, but remained in control of costs and became more productive

- In contrast, many firms now struggling for survival, grew too quickly. They took on the highest increases in workload and turnover of any segment, but doubled the size of their workforces and their levels of debt

Customer experience is key for competitive advantage

- Facing rising costs, the ability to compete on price is getting smaller. Customer experience has become the new source of competitive advantage. Most leaders said good service now requires same-working-day fixes for reactive jobs (68%) and that customers be kept fully informed digitally (65%)

Technology is critical in helping firms thrive

- Technology spending across the sector increased by an average of 54% in the last 12 months as firms focused on job management, productivity and customer experience

- Users of job management technology grew faster, on average, than those relying on spreadsheets and paper processes last year. They are in a better position to take on further work and deliver it profitably in the year ahead

- Most leaders expect spending in this area to continue growing into 2022

A Defining Period for the Field Service Sector

The following 12 months will be pivotal for field service firms. Everyone has the opportunity to grow, but they must manage significant cost increases and face major challenges recruiting and retaining skilled frontline operators.

It will be a year of abundance for some – gaining market share and driving growth in turnover and profitability. Others will see their margins eroded further. Everyone would benefit from becoming more productive and competing on customer experience rather than price.

Further Reading:

- Read more about FSM Technology

- Read more about BigChange on Field Service News

- Learn more about BigChange

- Follow BigChange on Twitter

- Access 17 premium resources on Service Strategy (PRO)

- Access 23 premium resources on selecting and implementing FSM Technology (PRO)

- Access 24 premium resources on recovering from the pandemic and the new normal (PRO)

This content is sponsored by BigChange

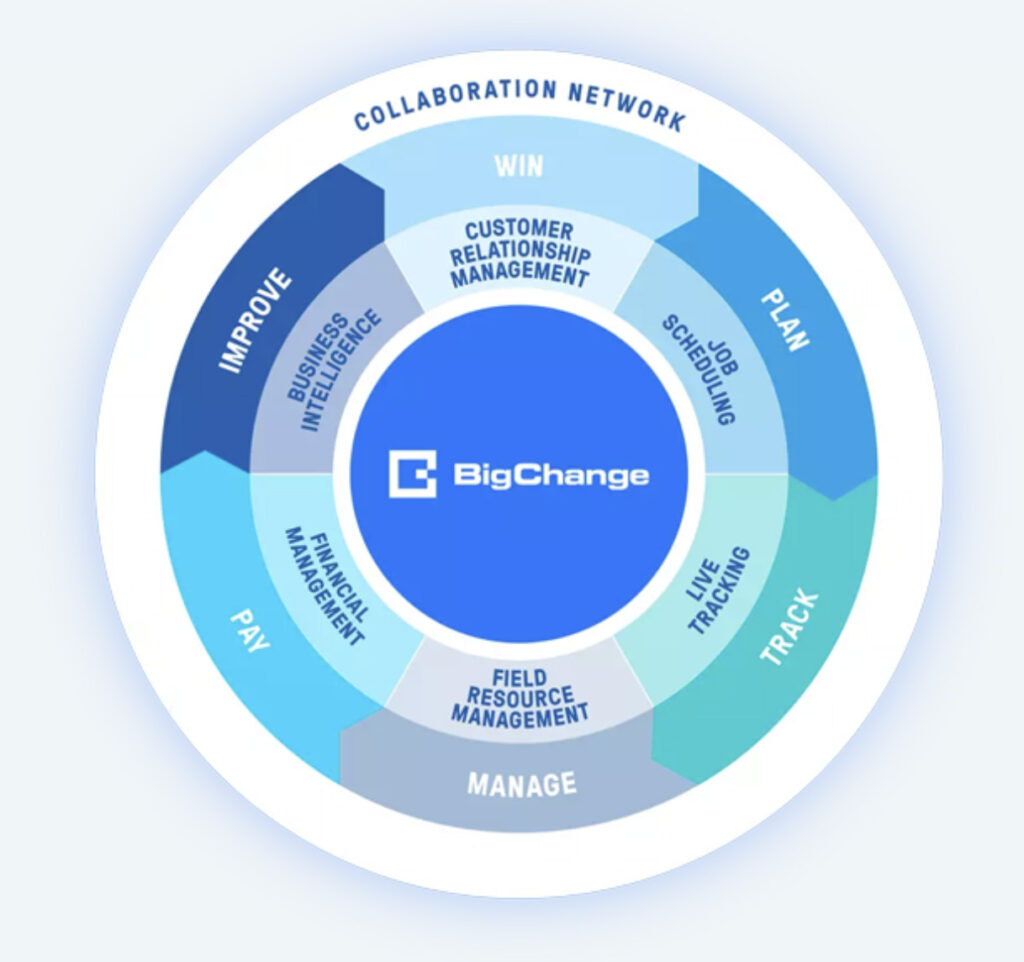

TAKE CONTROL WITH THE COMPLETE JOB MANAGEMENT

PLATFORM

Simplify how your business runs, connect your office and field workers and manage your entire operation from quotation to invoice on a mobile or tablet.