Critical trends in the telecommunications industry

To understand the issues impacting the telecommunications industry, in the first feature from a recent white paper written by Michael Blumberg, President of Blumberg Advisory Group, in partnership with IFS, we begin with an examination of key trends which

make these outcome-based service models possible.

There is no other industry in our modern-day economy characterized by hyper-competition, high growth, and massive disruption as much as the telecommunications industry. The roll-out of new technologies improves how telecommunication companies operate their networks, deliver service to their customers, and communicate with each other. Several technology trends make this environment possible, including 5G and Fiber Optic deployments, Artificial Intelligence, Machine Learning, the IoT, and Edge Computing.

These technologies are instrumental in the creation of outcome-based service models where customers purchase the outcome that the product or service provides rather than the product or service itself. Under the outcome-based model, the customer and supplier agree on measurable and attainable service outcomes that are designed to ensure customer success.

To meet outcomes, telecommunication suppliers (e.g., telcos) must ensure that their internal processes and operations can support these new models. However, the legacy systems infrastructure in place at many telcos makes it challenging to meet outcome-based performance metrics they’ve established for themselves and their customers. Fortunately, telcos can overcome these obstacles by implementing new technology solutions we examine in this whitepaper.

5G NETWORK DEPLOYMENTS

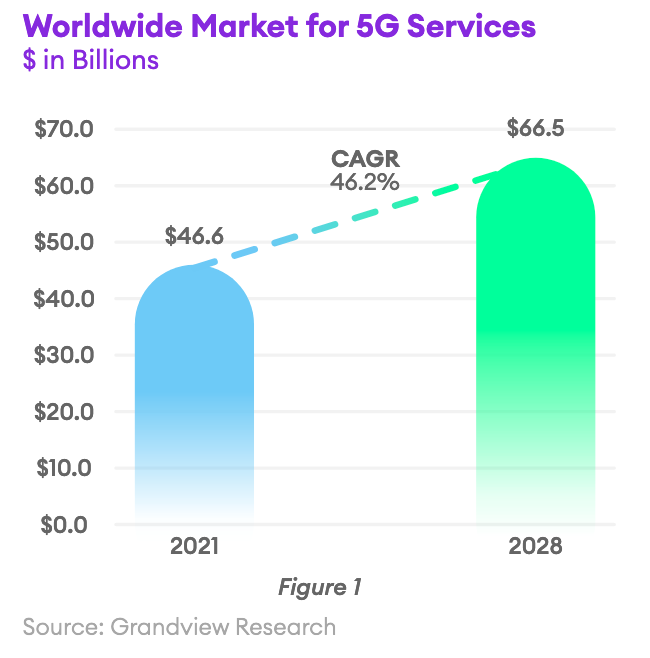

Probably the most significant trend impacting the telecom industry is the roll-out of 5G networks. Telecommunication companies have invested and will continue to invest heavily in 5G because it brings faster speed, lower latency, increased availability, and greater capacity to mobile networks. This capability is critical as people become increasingly dependent on mobile devices and demand high-quality and highly reliable wireless network communications. 5G also makes Augmented Reality, IoT, Edge Computing, and other disruptive technologies possible. According to Grandview Research, 5G services represented a $46.6 Billion global market in 2021. Grandview predicts this market will reach $66.5 Billion by 2028.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content IFS who may contact you for legitimate business reasons to discuss the content of this briefing report.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content IFS who may contact you for legitimate business reasons to discuss the content of this briefing report.

This content is available for FSN PRO members and also for a limited period for FSN FREE members. Please make sure you are logged in to access this content.

Not yet subscribed? Instantly unlock this content and more on our forever-free subscription tier FSN FREE

Join FSN FREE today!

Subscribe to our forever-free subscription tier FSN FREE by completing the brief form below and get instant access to this resource plus a selection of premium resources every month.

[pmpro_signup submit_button="Get access now!" level="1" redirect="referrer" custom_fields="true" short="true"]

"Gartner predicts that 75% of data will be processed outside a traditional centralized data center or cloud by 2025."

FIBER OPTIC CABLING

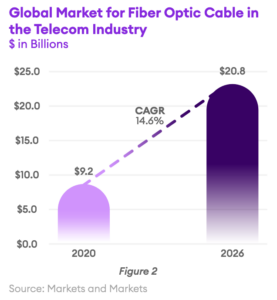

In parallel to 5G rollouts, telcos will continue to deploy fiber optic cable to support their broadband internet and long-haul backbone networks. According to Market and Markets, the global fiber optic cable market was $9.2 Billion in 2020 and it is forecast to reach $20.8 Billion by 2026. Several factors are driving this growth. First, the demand for high-speed home internet connections has increased exponentially as millions of workers around the globe switched to work from home models.

Second, while fiber optic provides fast internet speed to the customer premises (i.e., home, building, factory, etc.), consumers may find the signal strength weak throughout the building, mainly when broadcast to multiple rooms or floors. To overcome this challenge, building owners and homeowners can turn to structured cabling solutions from their telcos or installers to run fiber optic cables throughout the entire structure.

Third, fiber optic cable enhances the signal strength of 5G wireless networks. At issue, 5G has limitations regarding long-range effectiveness and the ability to penetrate walls and other structures. Telcos are beginning to combat this issue with back-haul networks to boost 5G coverage effectiveness. Back-haul networks built upon fiber optic cabling provide the bandwidth necessary to transmit data at a rate consistent with the speed of 5G networks. The deployment of fiber optic cable will increase as the demand for 5G wireless continues to grow.

ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

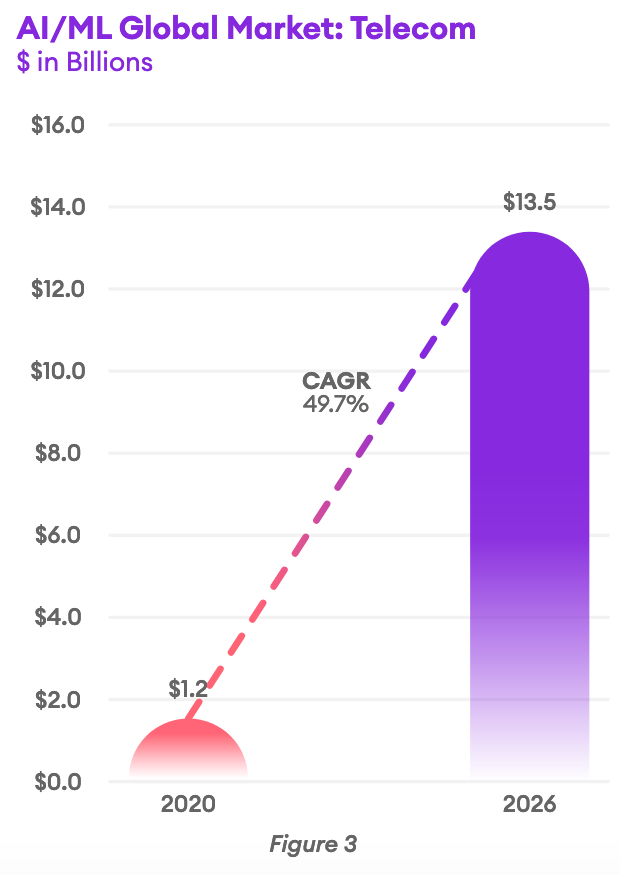

Telcos are increasingly utilizing AI/ML to improve their operations and deliver a better service experience. According to Forbes, “Telecommunications is one of the fastest-growing industries that uses AI/ML in many aspects of their business.” AI/ML offers several uses cases for telcos.

These include:

• Automated Customer Service: AI-powered tools like chatbots, virtual assistants, and conversational AI enable telcos to improve the customer experience (CX). These technologies help reduce customer wait times and telephone hold times by automating customer support interactions resulting in high customer satisfaction. By 2020, customers will manage 85% of their relationship with the enterprise without interacting with a human, according to Gartner Predict.

• Predictive Maintenance/Proactive Service: By utilizing AI/ML, telcos can generate and process a volume of statistical data to predict future trends and continuously evaluate their networks for potential problems and pitfalls. As such, telcos can proactively anticipate and avoid service issues before they occur, resulting in improved quality of service and higher customer satisfaction. In addition, AI/ML also enables telcos to be more effective and efficient in planning and optimizing resources such as spare parts and field service engineers’ schedules.

• Network Optimization: With telecom networks becoming more complex through the roll-out of 5G networks, telcos are turning to AI/ML to predict peak traffic and enhance network capability. By utilizing data analytics made possible through AI/ML tools, telcos can boost network performance and cut costs through automation.

With consumers demanding rapid response through an Uber-like CX, telcos cannot afford not to implement AI/ML tools. The market for AI within the Telecommunication Industry will reach $13.5 Billion globally by 2026. According to Valuates Reports, this figure is up from $ 1.2 Billion in 2020.

"45% of IoT generated data will be stored, processed, and analyzed at theedge of networks by 2023, according to IDC.”

INTERNET OF THINGS

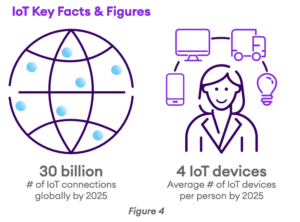

We are all familiar with the rapid proliferation of the Internet of Things (IoT) devices in consumer and industrial markets. IoT technology makes it possible for smart, connected and autonomous processes and operations, enables smart buildings, homes, cities, and autonomous automobiles and manufacturing facilities.

With the growing demand for IoT in many industry sectors, telcos will need to find ways to sustain and support end-user requirements for real-time, always-on, connected communications. 5G wireless networks best meet these requirements because they facilitate high-speed and low latency IoT devices. As a result, telcos continue to expand and upgrade their networks to respond to the growing demand for real-time IoT data communications.

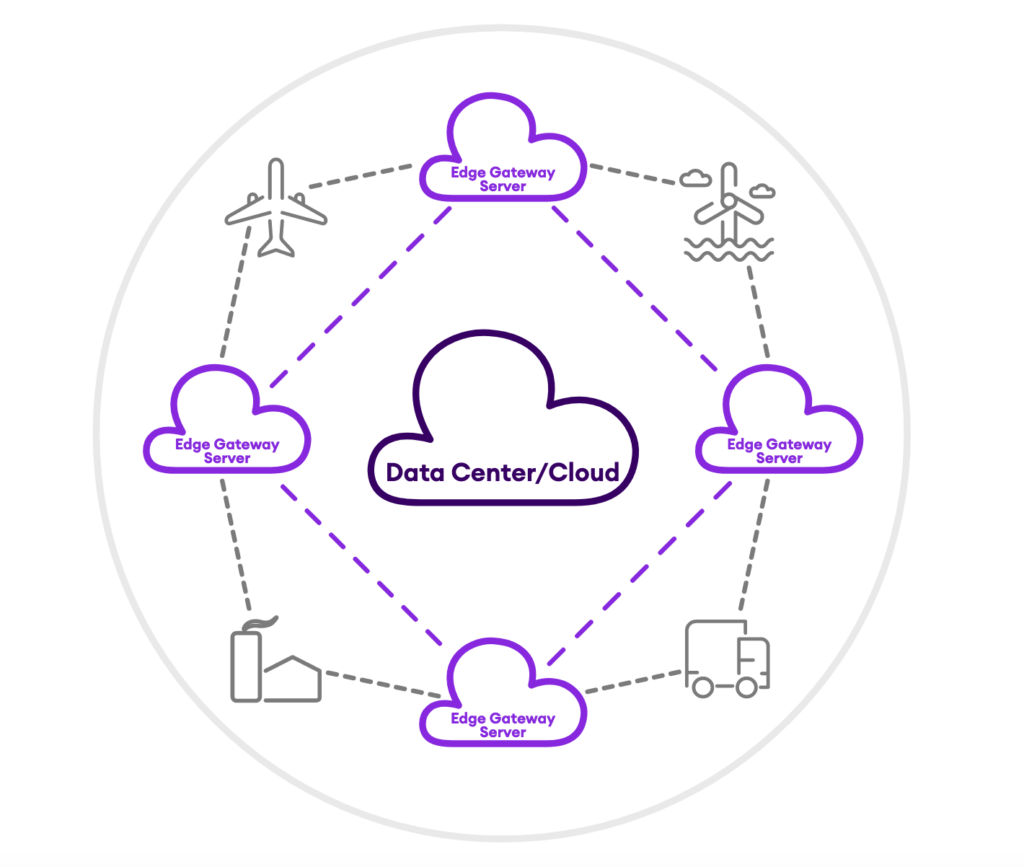

EDGE COMPUTING

Computer processing has begun to move away from on-premises and cloud-based data centers to the edge of the telecommunications network for consumers and enterprises. IoT devices, AR, 3D printing, and video streaming are a few examples of edge computing applications. In addition, with the increase in remote workers and intelligent enterprises, telcos need to assist end-users in bringing their AI and big data applications closer to the customer site.

As with IoT and AI applications, 5G networks ensure fast speed, low latency, and high connectivity of Edge applications and computing devices. The increased demand for edge computing will likely push the boundaries of 5G network capacity. Telcos have two options to deal with this issue—they can either utilize the edge computing services of internet providers like Google and Amazon or develop a dedicated edge computing infrastructure themselves.

Nevertheless, telcos will need to ensure the effective connectivity and synchronization of edge servers with telecommunications infrastructures regardless of which option they select. The opportunity for telcos to provide this type of service is significant. According to ABI Research, synchronization between edge servers and telecom infrastructures will represent a $54 Billion opportunity by 2023. This opportunity should come as no surprise. The analyst firm IDC estimates that almost half (45%) of IoT-generated data will be stored, processed, and analyzed at the edge of networks by the same time.

Edge computing streams generate a substantial amount of service needs and revenue stream to market participants. Telcos will no doubt want to capture a significant share of this opportunity. However, they may face competition from computer and network connectivity OEMs, software vendors, and internet providers who opt for market share. It is likely the telcos will be involved in edge computing for the long haul.

Do you want to know more?

If you are already a subscriber you can access the report instantly on the ‘read now’ button below. If the button is showing ‘Join FSN FREE’ please log-in and refresh the page.

If you are yet to subscribe simply click the button below and complete the brief registration form to subscribe and you will get instant access to this report plus a selection of premium resources each month completely free.

This content is available for FSN PRO members and also for a limited period for FSN FREE members. Please make sure you are logged in to access this content.

Not yet subscribed? Instantly unlock this content and more on our forever-free subscription tier FSN FREE

Join FSN FREE today!

Subscribe to our forever-free subscription tier FSN FREE by completing the brief form below and get instant access to this resource plus a selection of premium resources every month.

[pmpro_signup submit_button="Get access now!" level="1" redirect="referrer" custom_fields="true" short="true"]

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content IFS who may contact you for legitimate business reasons to discuss the content of this briefing report.

Data usage note: By accessing this content you consent to the contact details submitted when you registered as a subscriber to fieldservicenews.com to be shared with the listed sponsor of this premium content IFS who may contact you for legitimate business reasons to discuss the content of this briefing report.