In our current series of articles analysing an exclusive research run by Field Service News Research in partnership with FieldAware our latest analysis of the findings show am industry at the peak of change…

As we continue our series of features reflecting on a research project run in partnership with FieldAware, an important question to understand is whether what we are seeing in terms of the move towards advanced services is the direct result of the pandemic or if this is this the continuation of a trend that has been slowly emerging across the last decade?

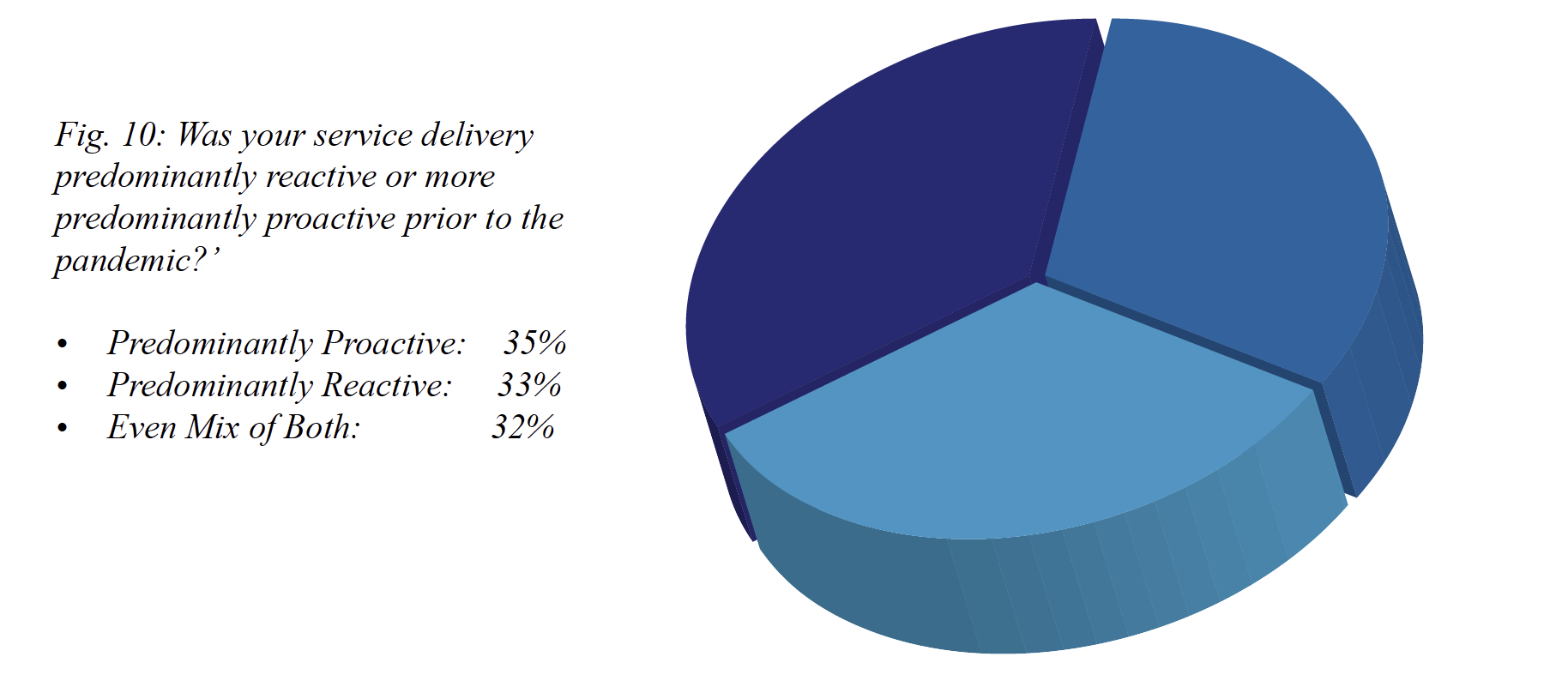

A good place to look for some data to support either hypothesis would be in the question ‘was your service delivery more reactive or more proactive prior to the pandemic?’

Here we saw a real snapshot of an industry that is apparently right in the middle of the shift from being reactionary to becoming proactive. In response to this question we saw an almost completely even split across the three options we provided to the respondents. These were predominantly reactive 33%, predominantly proactive 35% and an even mix of both 32%. (figure 10)

However, there is evidence that this shift does seem to have been impacted by the pandemic at least to a degree. With half of the respondents stating that the balance between reactive and proactive service in their organisation had changed as a result of COVID-19. Of course, as we saw customer prioritisation becoming common place it could also possibly be that preventative work was put aside to attend to more emergency reactive needs, in essence seeing the service evolution we have witnessed regress somewhat.

This is an area that we will be exploring in the second phase of this project where we shall be conducting further interviews with a selection of respondents to find further insight beyond the analysis of the quantitative data.

Regardless of the impact of the pandemic will have had in the short-term, the data presents a clear picture of the future as we look towards the future in the mid-term. As with the data revealed earlier relating to trends both in remote service and also IoT, the data also appears to offer a very clear indicator that we will see the further adoption of advanced services and that this will become a commonplace inclusion within service portfolios for the majority of organisations.

Further evidence of this in the study appears when we see that of those companies that currently do not offer such solutions, over three-quarters (77%) are actively considering introducing an advanced service strategy. Meanwhile, of those respondents that have active experience of operating such service offerings, over nine in ten (93%) state that they believe advanced service offerings will become more attractive to customers post Covid-19.

To add even further weight to the belief that we are hurtling into a far more service-centric economy than we operated in at the start of the year, again over nine out of ten (91%) of all respondents also felt that we would see the perception of the importance of service and maintenance will increase as we move through recovery. This is a particularly positive finding for the field service sector, where the shift to more predominantly service-centric revenue streams is already appearing to be borne out.

Currently almost three quarters of all field service companies within this study already attribute at least half of their revenue to service versus product revenue while a third of the total response set (33%) attribute three quarters (75%) of their revenue to service. Further to this almost half (48%) of field service companies in the study believe that their revenue split will be more weighted towards service both during and beyond the recovery.

Want to know more?

Want to know more?

You can find the full paper in the premium resource library.