Perhaps one of the most important findings in our recent groundbreaking study run in partnership with FieldAware was shining a light between those field service organisations embracing technology and the laggards…

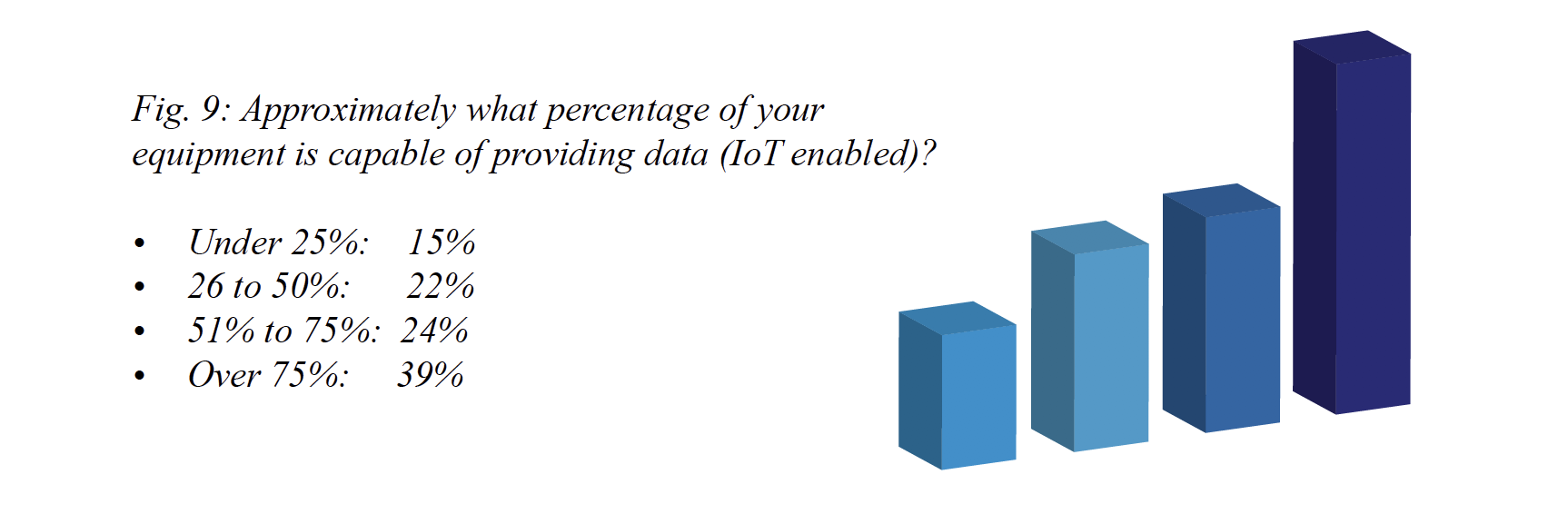

One insight that emerged from the study which was something of a surprise was that amongst those companies with IoT enabled assets, it appears the trend is towards having such capabilities across the majority of the fleet rather than building this forward in an iterative basis.

In fact, as we see from the graph below (figure 9), there is a distinct step pattern here which indicates that amongst those companies that do have IoT enabled assets, the dominant approach is to have over three quarters or more of the assets in the field connected. This is stated by over a third (39%) of organisations as their current situation, while a quarter of companies (24%) have between 51and 75% of their assets connected, just under a quarter (22%) have between 25 and 50% of assets connected while only 15% have less than a quarter connected.

This would seem to suggest one of two things. Firstly, that once the decision is made to move to a connected asset fleet, it is sensible to make that deployment as widespread as possible, potentially to avoid the headache of having legacy systems and new systems being used in tandem. Secondly, it would seem to suggest that those companies that have embraced IoT are reasonably mature in their adoption of the technology, at least in terms of the fundamental infrastructure of a network of connected assets.

For those companies who are yet to start their digitalisation journey with regards to IoT this could be a worrying trend as it suggests that the gap between the early adopters and the laggards is getting potentially too wide to be bridged. Given the numerous external threats of the pandemic, a hesitancy to act now and embrace IoT, could mean falling further behind until the competitive advantage of those companies who did act early is to great to be overcome.

The good news is that even now, half of the market appears to still be playing catch up in this regard, so if this is your company, you are not alone and there is still time to act.

In addition to this, the benefits to being a slower adopter of an emerging technology is that you can allow others to make mistakes, so you don’t have to.

We are now at a point where over two thirds (67%) of companies now state that they have no issues getting access to machine data feeds that are on a customers’ site – traditionally one of the most challenging aspects field service organisations faced with regards to IoT. Interestingly, for those who still have a challenge in doing so the most common issue is ‘customer concerns over security’ cited by 35% of the respondents, followed by a lack of ‘connectivity on site’ cited by 33% and finally ‘customer concerns of data ownership’ cited by 24% of respondents.

Perhaps the biggest indicator of the maturity of IoT use within field service delivery though is in the effectiveness of how organisations that are doing so are leveraging that data and turning it into both insight and actions.Here we see that there is a genuine best-in-class emerging which is just over a fifth (21%) of organisations who state that they are using data effectively. Beyond that we see just under half (43%) of respondent companies state they are utilising data effectively, but it requires improvement, while over a third (34%) of field service companies admit they are not using asset data effectively enough.

Again it seems that while the foundational layer of an IoT infrastructure seems to be emerging in our sector to build upon, at the moment those who are leveraging the data connected assets yield effectively, remain within a minority. This would suggest that we will see a continuing maturation of such capabilities within the coming 12 months.

Want to know more?

Want to know more?

You can find the full paper in the premium resource library.