In the final feature from our series analysing an exclusive Field Service News Research project run in partnership with Salesforce we reveal three key areas of questions field service companies must face in light of the studies findings…

The findings of this study have reaffirmed certain assumptions that we may have held about the impact of COVID 19 on the field service sector, and specifically the rapid rise of remote service delivery as a viable and widespread model for service delivery both now and in the future.

However, as is often the case when looking for trends within a rich and well-focused data set such as this study, as we begin to find answers to our initial questions, we see further, better-defined questions of even greater importance emerge.

This has certainly been the case here with several vital questions field service companies must consider being revealed by the data.

The anticipated shift to a remote-first approach to field service does indeed appear to have genuinely taken place with the overwhelming majority (88%) of service companies now having at least some capabilities in this area.

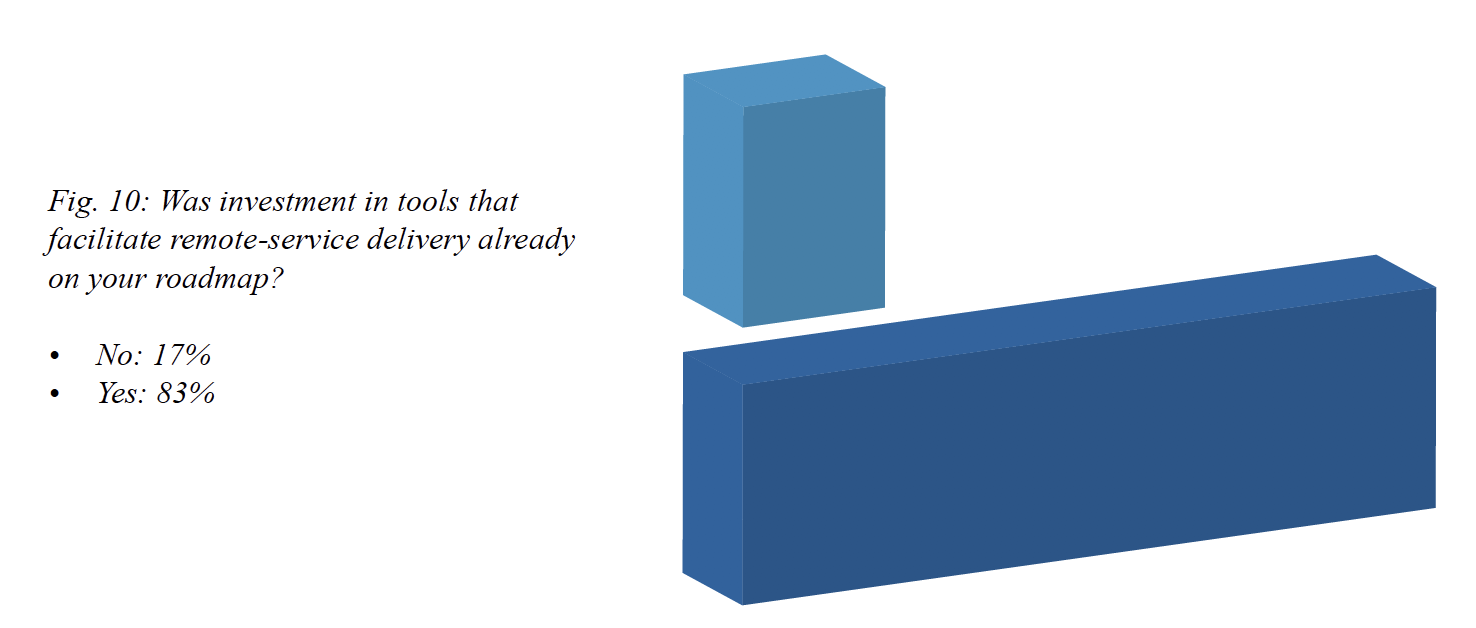

It is also evident that while the key driver behind this mass adoption has, of course, been the pandemic, many companies were heading down this path already. While 50% of field service companies within the study stated they had invested in technology as a result of the pandemic, 83% of companies indicated that investment in remote services was already on their roadmap (figure 10).

This is a crucial point to note, for while the pandemic has accelerated the mass adoption of remote services, a major factor in the considerable success of most implementations of such an approach was that the tools available and the platforms these tools sit upon, such as Salesforce Field Service, were mature, well developed and ready to go. It is an essential reminder of the importance of having a robust technological infrastructure that can empower field service companies to be able to make such significant changes to their processes with minimal pain.

As Gary Brandeleer, Senior Director of Product Marketing, Salesforce Field Service explained during his appearance on The Field Service Podcast, “what we saw with COVID-19, was that the companies who didn’t control their basics, were unable to react and adapt fast enough. These technologies are really, really impactful, but can only be impactful if you have the right data. They can only be impactful if you are already connecting your install base, if you’re already doing warranty tracking, if you already know all about your customer when they pick up the phone to you.”

However, while this is of course is of great importance and aspirational advice for field service companies seeking to deliver service excellence, the fact is this study reveals the levels of sophistication in how service is delivered remotely remains hugely varied. We are certainly seeing the emergence of best-in-class companies within this regard with less than a quarter of field service companies using Augmented Reality to deliver remote services. This leads us to the first line of questioning field service companies must ask themeselves:

This leads us to the first line of questioning field service companies must ask themselves:

- If remote services are to become a standard mechanism for service delivery, are we prepared to invest in our capabilities to deliver service remotely?

- Is our intention to deliver remote service in a manner that allows us to use our service delivery standards as a differentiator against our competition?

The study has also revealed that while there are numerous benefits to adopting a remote-first approach, there are also significant downsides to having our field service engineers or technicians spending less time onsite with the customer.

What is interesting is that on both sides of this equation, an argument can be made for a more advanced level of service agreement.

Indeed, the key benefits of remote-first as a default that were identified within the study for both the service providers themselves, such as much faster response times (89%) and less geographical restrictions (84%) and also for their customers such as quicker response times (93%) and better uptime (61%), all sit well within a servitized or outcome-based model of service agreement.

Yet, equally, the reduction of the service engineer or technician onsite could be seen to potentially lessen the more partnership-based relationships that advanced service strategies are built upon by potentially diminishing the trusted advisor role of the engineer which is a concern for 81% of respondents, and simultaneously reducing the customers’ opportunity to discuss best practice with a subject matter expert which a quarter (25%) of respondents stated was the single biggest value their customers see of having an engineer onsite.

In a previous study by Field Service News (also conducted in 2020) we revealed that a shift towards servitization/advanced services is beginning to firmly materialise with two-thirds (66%) of companies stating that they either already have or are currently actively implementing at least some form of advanced service offering.

This is important to take under consideration because as we have already pointed out, it is almost inevitable that we will begin to see hybrid models evolve that blend the best of remote-service delivery and physical onsite service delivery.

The broader approach of an organisation’s service strategy, whether it be servitized, outcome-based or traditional break-fix, has to be taken into consideration and must shape how such a hybrid model will evolve for each field service organisation.

This is the second important line of questioning field service companies must ask of themselves:

- Will remote services become one layer within part of broader service offering?

- Is the use of remote service delivery to be part of an advanced service offering and aligned to guarantees of uptime, or is it be viewed as a direct replacement for our traditional onsite break-fix approach to service delivery?

The final important insight that the study revealed is that there appears to be much uncertainty about how remote services should be priced. That uncertainty is evidenced by the very even split of companies currently charging less for remote service than onsite, those charging the same and those who do not charge at all. Only 4% of companies stated they charge more for remote services.

It is clear at the moment that the notion of how field service companies should charge for remote service delivery is at best ill-defined. Again, this is something that Brandeleer touched on The Field Service Podcast stating;

“One problem that I’m hearing from some customers is that it’s challenging to invoice remote assistance calls because the customer is saying ‘you didn’t send a technician onsite so are you going to charge me the same price? I think that’s where you need to go back to the customer and say, ‘okay, maybe we should hold a service contract review.’ This is where field service companies can really start creating new business models, where you create a real partnership-based relationship with your customer. Its bringing a new base line for innovation in business models.”

Again, as we are thinking of new operational approaches to service delivery, as we are defining new hybrid means of delivering service, now is the time to absolutely make sure we have a firm definition of the value proposition of our service delivery.

This is the third line of questioning that field service companies must consider:

- What is the real value proposition of our service offering that we deliver to our customers?

- Within that, what is the value of remote service compared to onsite service delivery?

As hackneyed as the phrase has rapidly become, we are building the new normal. Remote service will be a significant part of that future. These three areas of discussion that are now key for those field service companies who wish to embrace that future and flourish within it.

Want to know more? The full paper is available in the premium resource library

Want to know more? The full paper is available in the premium resource library