Data in Field Service – the Potential and the Pitfalls

We cannot, of course, talk about the core metrics that are being measured by Field Service organisations without touching upon the most significant issue of the modern industry today – the sheer breadth and depth of data.

In today’s connected world, there is just simply so much data being created that we are very much in danger of being overwhelmed and consumed by it unless we are not careful. Paralysis by analysis can be a genuine issue that can stifle innovation. In a customer-orientated world, the ability to adapt quickly is becoming a crucial aspect of modern business. Yet, at the same time, as is the increasingly hackneyed phrase ‘data is the new gold’.

The ability to be able to monitor, measure and then dissect each aspect of our operation – whether it be internally within our teams and operations or externally with regards to our customer interactions, can offer us the ability to leverage vast amounts of untapped insight into our businesses that can literally open up new revenue streams or at least maximise to the fullest potential those we already have in place. So how do we tread the line between insanity and genius when it comes to getting the most out of our operational data?

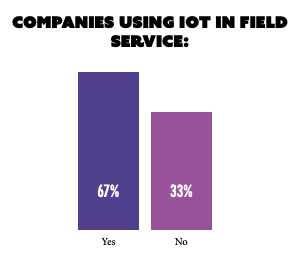

Well, first of all, let us take a look at some of the headline metrics from the research when it comes to collecting operational asset data.

- 67% of field service companies are now using IoT to provide data from assets in the field.

- 72% of these companies are using data from connected assets to predict failure and schedule maintenance around this data

- 54% of these companies can interpret data from assets in the field when providing triage

- 23% of these companies factor this data into the way they analyse field service KPIs

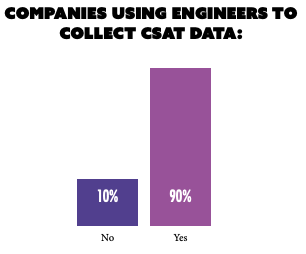

Then if we compare this to how CSAT data collected by the field service operative themselves are adapted into KPI measurements:

- 90% of field service companies collect some element of CSAT data

- 87% of these companies expect engineers to collect this data directly from the customer while on site.

- 100% of these companies factor these results into their KPI performance

The findings outlined above would suggest that there is something of a disconnect between how field service companies at large are taking advantage of some sets of data compared to others.

So why is this?

One suggestion here is that while for many organisations, the introduction of CSAT programs such as NPS has been explicitly designed to work within a program of KPIs.

One suggestion here is that while for many organisations, the introduction of CSAT programs such as NPS has been explicitly designed to work within a program of KPIs.

Indeed, this is their fundamental purpose, so it makes sense that this data would be automatically positioned where it can yield insight. In addition to this, the means of collection is straightforward – it can be built into the engineer’s on-site workflow alongside picking up a signature for job completion.

Also, the prevalence of NPS, for example, is mostly down to the simplicity of its design which again lends itself to the straightforward interpretation of the data collected. IoT data, on the other hand, is an entirely different ball game. In essence, as one respondent explained during a follow-up interview “CSAT data comes in neat little condensed parcels of insight that yield exactly what we need to know, IoT data, on the other hand, is a needle in a haystack time unless you in advance what it is your looking for.”

To begin, the ability to collect vast sets of data not just at the asset level but also the component level can lead to simply too much data being presented to make any meaningful sense. It is crucial in this respect to understand what output we wish to measure – such as productivity or performance and then work back from there. To work in the other direction, from the ground up, when there is so much potential data to be analysed, would be a sure-fire way to get lost in the task.

As we’ve explored in this report, while the exact ‘hows’ and ‘whys’ of the KPIs field service companies are measuring may be changing, fundamentally, at the most fundamental level, the ‘whats’ largely remain the same. Even amongst those organisations who are embracing new service-centric strategies such as servitization and outcome-based-solutions are utilising the same core existing KPIs that have always dominated amongst field service companies when it comes to tracking efficiency, first-time-fix rates and technician utilisation rates.

As we’ve explored in this report, while the exact ‘hows’ and ‘whys’ of the KPIs field service companies are measuring may be changing, fundamentally, at the most fundamental level, the ‘whats’ largely remain the same. Even amongst those organisations who are embracing new service-centric strategies such as servitization and outcome-based-solutions are utilising the same core existing KPIs that have always dominated amongst field service companies when it comes to tracking efficiency, first-time-fix rates and technician utilisation rates.

With this in mind, it is of course, far harder to work data from assets in the field into the KPIs we are using to measure field service performance.

However, the fact is that when it comes to KPIs within field service, we must ask is intelligence from the assets essential in the way CSAT data is? The answer is that it appears not, and this is a crucial point to note. IoT data offers us the chance to provide our engineers with the critical data that allows them to hit the KPIs that matter – and these have remained constant and will likely do so for many more years underpinning our industry as it evolves.

The most significant aspect field service companies must put in place now is the ability to drive meaningful insight from that data in the field to harness it to help us hit the three critical pillars of CSAT, Productivity and Task Completion. IoT, AI and Cloud computing are set to be critical tools in achieving this in the future.

Want to know more?

FSN PRO and FSN PRO+ users can find the full paper this article is taken from in the premium resource library.

Find out more about our premium membership options here