As we continue our series exploring the findings of an exclusive Field Service News Research project run with FieldAware, we analyse what the financial impact of the pandemic will be on our sector…

The impact of the pandemic and the subsequent lockdowns will be felt for a long time and in many different ways. However, perhaps the most overt and significant impact initially will be financial. Quite simply the world, including the majority of industry, was put on hiatus, on a global basis, for a period of at least two solid months. In the intervening months between the worst of the pandemic the tentative steps towards recovery have been intermittent, inconsistent and fractured.

Such a hard-stop followed by ongoing uncertainty has of course, inevitably hit many companies across a huge array of industries incredibly hard. For field service companies, the impact has to a degree been something of a domino effect. With cashflow being so suddenly and severely restricted in the market, bills are increasingly likely to go unpaid, or at least no longer be paid on time.

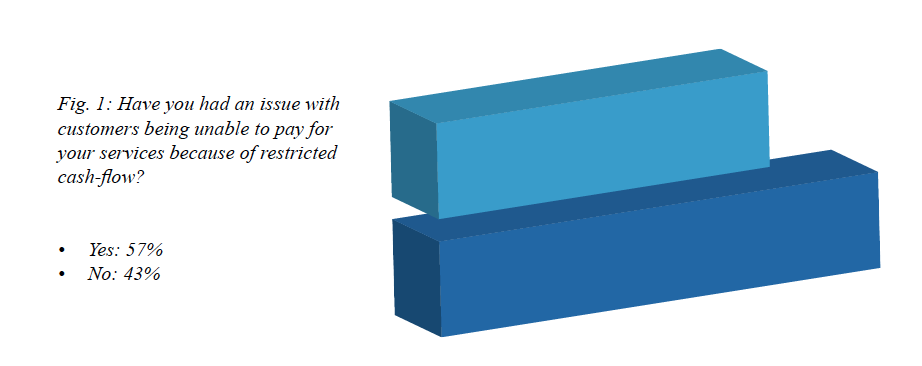

In our study we asked respondents if they had faced an issue with customers being unable to pay for their services because of restricted cash flow.

Over half of the respondents (57%) responded that this was indeed the case (figure one). While this number may be lower than some analysts might have predicted, it remains a sizeable proportion of our sector that was being impacted financially.

What is interesting when we begin looking a little deeper is that smaller organisations have been hit disproportionally hard by this reduction of available cash within the market. When we look at those organisations with less than 50 field service engineers, we see that the number of organisations that have had issues with customers paying for their services shift to over two-thirds (69%) of respondents.

However, perhaps somewhat paradoxically, there is more optimism within companies of this size compared to their larger counterparts that this will be relatively short-term issue to overcome.

In fact, just under half (44%) of the respondents within this company size stated that the time horizon in which this would be resolved would be within 90 days.

When we look at the results to this question from companies with more than 500 engineers, the most common prediction for the resolution of cashflow challenges within the market is 2 years which was cited by nearly a third (31%) of respondent companies within that larger sized organisation segment.

While the on the one hand, the economic challenges of a global market recession, the deepest since the second world war (although in fact still less than half of the 1945/46 recession), means obvious financial hardship for many organisations, there is an argument that for maintenance and repair related businesses we may actually see an increase in demand for their services.

This has historically been the case across the major recessions of the 30’s, post-war and 2008/2009 and the reasoning behind why this occurs is grounded in pragmatic responses to such environments. At times of downward economic momentum, investment in new assets is limited, while there is a greater focus on keeping existing assets operational as they are ‘sweated’.

While it may be early days for this effect to be kicking into full swing, we are certainly already beginning to see this trend emerging in within the COVID recession as well. We asked our respondents if they had seen an increase in requests for extended service contracts as customers seek to find ways to get enhanced lifespans for their existing customers.

Almost half (48%) of the total respondents answered in the affirmative.

“Customers’ are looking to save on capital outlay and also looking to extend life of assets while they assess the impact the changes to the business model will make to the stability of their company.”

As a follow up to this question we offered our respondents the chance to add comments in an open text box. There were a number of interesting answers that painted a picture of two very different forks in the road with regards to whether companies are seeing an increase in requests for extended service contracts.

From those respondents that had answered in the affirmative we saw some of the responses that we would perhaps have anticipated. As one respondent explained, “the pandemic has crippled all forms of businesses and making ROA employed in income generation almost asphyxiated. Hence, the call for service contract extension by customers.”

Meanwhile another respondent added “Customers are looking for short term solutions to repair and ensure equipment uptime, for fear of longterm implications and hope for medium term capital funds availability for replacement.”

A third commented “Customers’ are looking to save on capital outlay also looking to extend life of assets while they assess the impact the changes to the business model will make to the stability of their company.”

However, to really drive home the point that these are truly unprecedented times, a number of respondents who responded to the initial question in the negative, outlined a very different scenario.

One respondent outlined “If anything my customers are looking for ways to shape their organisations for the COVID world now and the post COVID one around the corner, sweating physical assets just doesn’t make sense anymore.”

Another respondent added “Companies need field service experts to do onsite visits and during the pandemic this has not been always possible. Customers will the look for other options.”

Finally, one particularly interesting comment was left by another respondent that indicates how many forward-thinking companies are beginning to rethink their approach to service offering strategies. This respondent commented “we have seen an increase in remote services and offering new service contracts to lock down customers who want priority.”

Want to know more?

FSN PRO and FSN PRO+ users can find the full paper this article is taken from in the premium resource library.