In the latest feature in our series analysing the findings of an exclusive Field Service News Research project, run in partnership with FieldAware, we look at the balance of service agreements between those being transaction based vs. true industry partnerships…

This closeness to customers is perhaps understandable given that the relationship between a service provider and their customers has largely become one that is centred around genuine partnership rather than a more transactional agreement.

True partnership-based relationships allow for much more closely integrated understanding of the challenges that our customers face. This, in turn, leads to opportunities to work with those customers to solve

their problems for them and alongside them. Ultimately of course, this leads to an environment in which customer loyalty is developed and new revenue streams for the service provider can be unearthed.

The study certainly revealed this to be the case with over three quarters (76%) of respondents stating that they believe their relationships with their customers are partnership based rather than transactional. Perhaps even more tellingly 92% of these respondents also believe that their customers share that view.

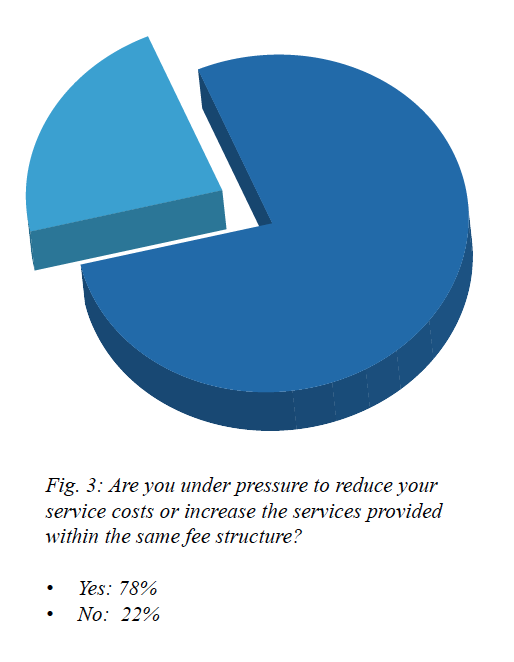

However, despite their being a general closeness between service providers and their client base in the main, for the majority of field service organisations, this hasn’t safeguarded them from feeling the strain of the pandemic on those customer relationships. Indeed, three quarters (78%) of field service organisations within the study admitted they had felt under pressure to reduce their service costs or increase the services provided within the same fee structure (figure 3). While there was slight variance in this number depending on the size of the respondent organisation (78% of SMB’s compared to 70% of enterprise level companies) the numbers remain consistent enough to state that this is being felt by all organisations of all sizes across the sector.

As a follow up to this question we asked our respondents to identify the reasons for this that they felt this pressure was being felt.

As a follow up to this question we asked our respondents to identify the reasons for this that they felt this pressure was being felt.

The majority of companies (64%) stated that they felt that market conditions were driving this pressure on service contracts, although just under half a (44%) also stated they felt customers were forcing prices down as well.

Slightly less respondents (40%) also stated that new market entrants and competitors were driving the price of service downwards.

This pressure was also felt across both new and existing customers for over half (53%) of the companies in our study.

Given the shifting and uncertain landscape that field service organisations are operating in, one might be forgiven for thinking that we would see something of a defensive mindset emerging amongst those companies within the study.

However, this appears to be a false assumption. Even in the face of such adversity, over three quarters (76%) of the respondents in the study state that they are focused on growth over survival in the next 12 months. It should be noted that such optimism diminishes amongst companies with a larger field service technician footprint of over 800 workers or more where we see the percentage of companies expecting growth dipping to just 57%.

Want to know more?

FSN PRO and FSN PRO+ users can find the full paper this article is taken from in the premium resource library.

Find out more about our premium membership options here